Australian Retail Sales Down YoY for the First Time in Six Months, but Preliminary Black Friday Results Look Promising

Monthly KRI Summary

Click on the image to enlarge

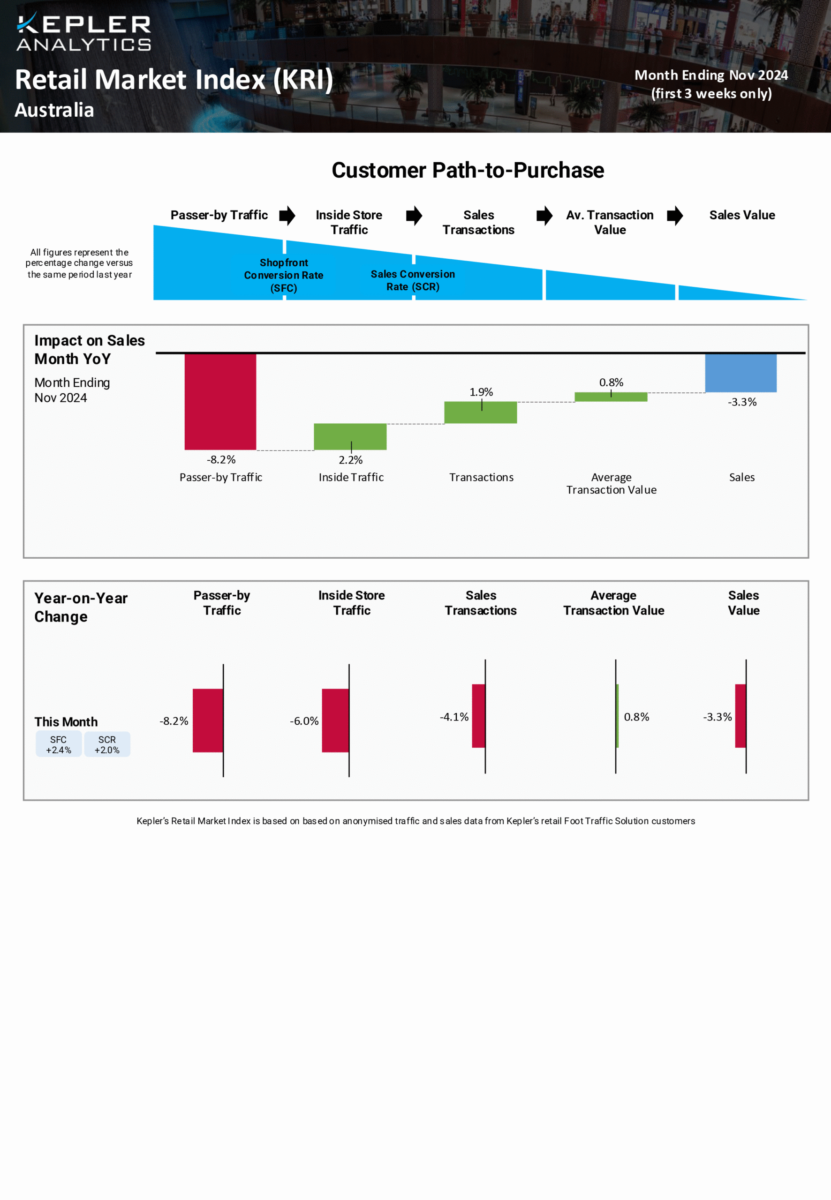

Discover key insights in the latest Australian Kepler Retail Market Index for November, focusing on the three-week period ending 24/11/2024.

Year-on-Year Performance Challenge: This month, analysing year-on-year performance is particularly difficult because Black Friday fell in the retail month of November last year (Friday, 24th November 2023) but falls in in the retail month of December this year (Friday, 29th November 2024). As a result, standard comparisons provide limited insight.

Performance Focus: To address this challenge, the commentary below will focus on comparing the first three weeks of November to provide a more accurate year-on-year performance.

Retail Foot Traffic: Australian retail foot traffic for the first three weeks of November was the weakest seen this financial year. Passer-by traffic decreased by 8.2% YoY, consistent with recent trends, while inside store traffic dropped by 6.0% YoY (compared to the recent trend of -4%). While part of this sharper decline can be attributed to consumers waiting for Black Friday sales, a concerning trend of declining Inside Store Traffic is emerging, with monthly drops becoming progressively worse (July +0.8%, August -1.9%, September -3.8%, October -3.9% and November -6.0%).

Sales Conversion: Sales conversion improved by 2.0% YoY in November, compared to being flat for the financial year to date.

Transactions: Transactions in November fell by 4.1% YoY, with the weaker inside store traffic partly offset by stronger sales conversion. The decline in transactions has also worsened over the financial year.

Average Transaction Values (ATVs): Growth in ATVs has been driving sales growth this financial year, offsetting the decline in transactions. In November, ATVs increased by a modest 0.8% YoY, reflecting higher promotional discounts across the market.

Sales: Sales in the first three weeks of November were down by 3.3% YoY, ending a five-month run of positive year-on-year growth.

Pre-Black Friday Comparison: A comparison of this year’s pre-Black Friday week (18-24 November 2024) with last year’s equivalent week (13-19 November 2023) presents a more optimistic picture. This year’s pre-Black Friday period outperformed last year’s, likely due to earlier promotional activities by retailers.

Pre-Black Friday Week Performance: During the pre-Black Friday week, inside store traffic increased by 5.8% YoY, sales conversion rose by 8.0% YoY, and sales were up by 14.7% YoY. Whether this indicates overall sales growth for the Black Friday period or a shift in sales timing remains to be seen. A comprehensive review of Black Friday period performance will be provided in the next fortnight.

Stay Updated: If you haven’t already, sign up for our daily peak trading period report to stay on top of market trends during this critical retail period.

SIGN UP HERE

About Kepler’s Retail Market Index

- Kepler’s Retail Market Index provides the most insightful and most timely view of retail industry performance across both Australia and New Zealand

- The index is based on anonymised data from Kepler’s Retail Foot Traffic Solution customers, primarily non-food specialty retailers

Want to know more? Get in touch to subscribe to the Kepler Retail Market Index

Did you miss our webinar?

Get insights on FY24 in Australia, where we will unpack what happened in the financial year 2024. Danny French, and Kylie Smart share detailed information on shopper behaviour and the impact on retail results including expectations for the financial year ahead.