Below is just a summary of our interactive KRI, If you would like to see its full capability, register below for a FREE Demo.

Click on the image to enlarge

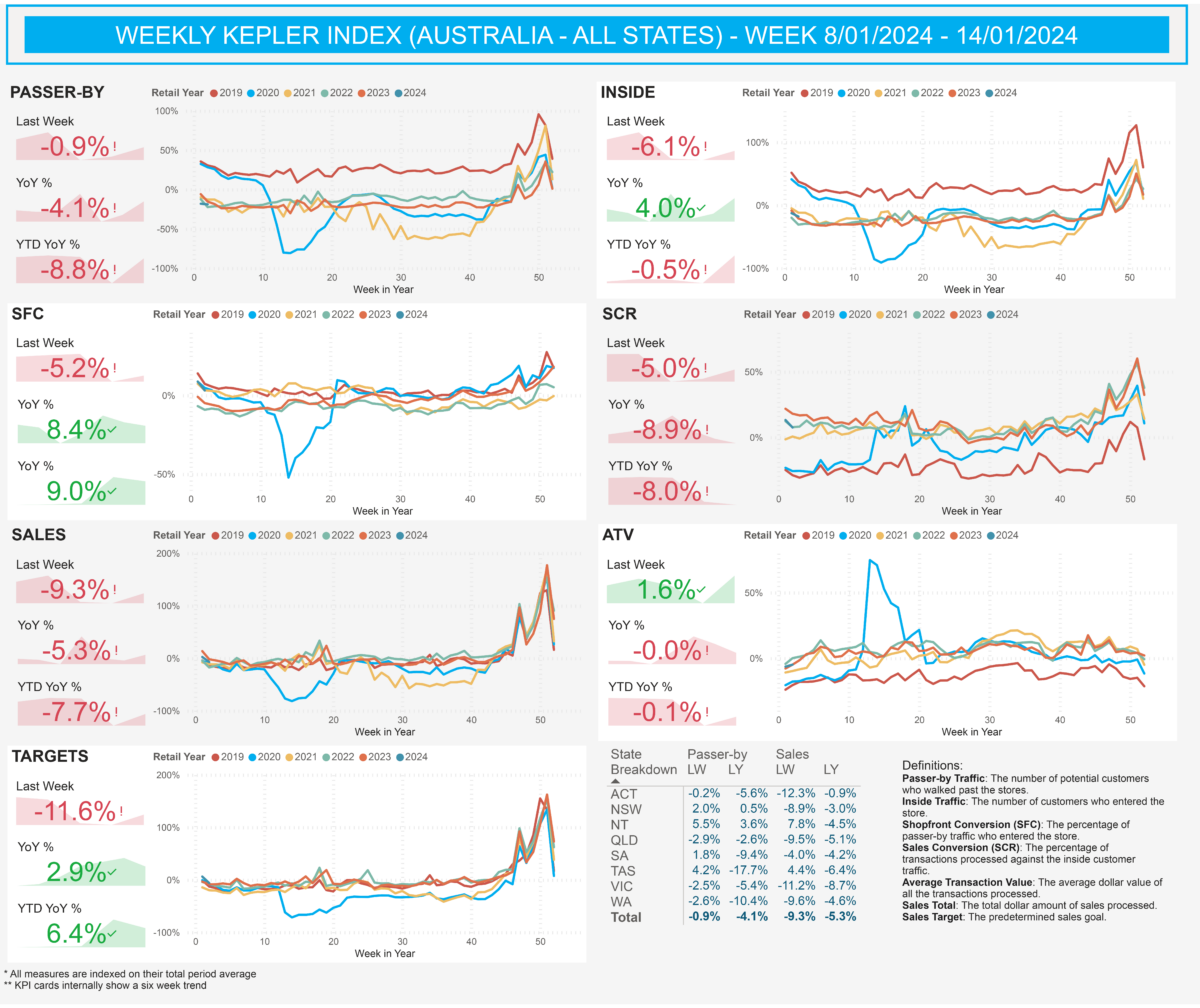

All States

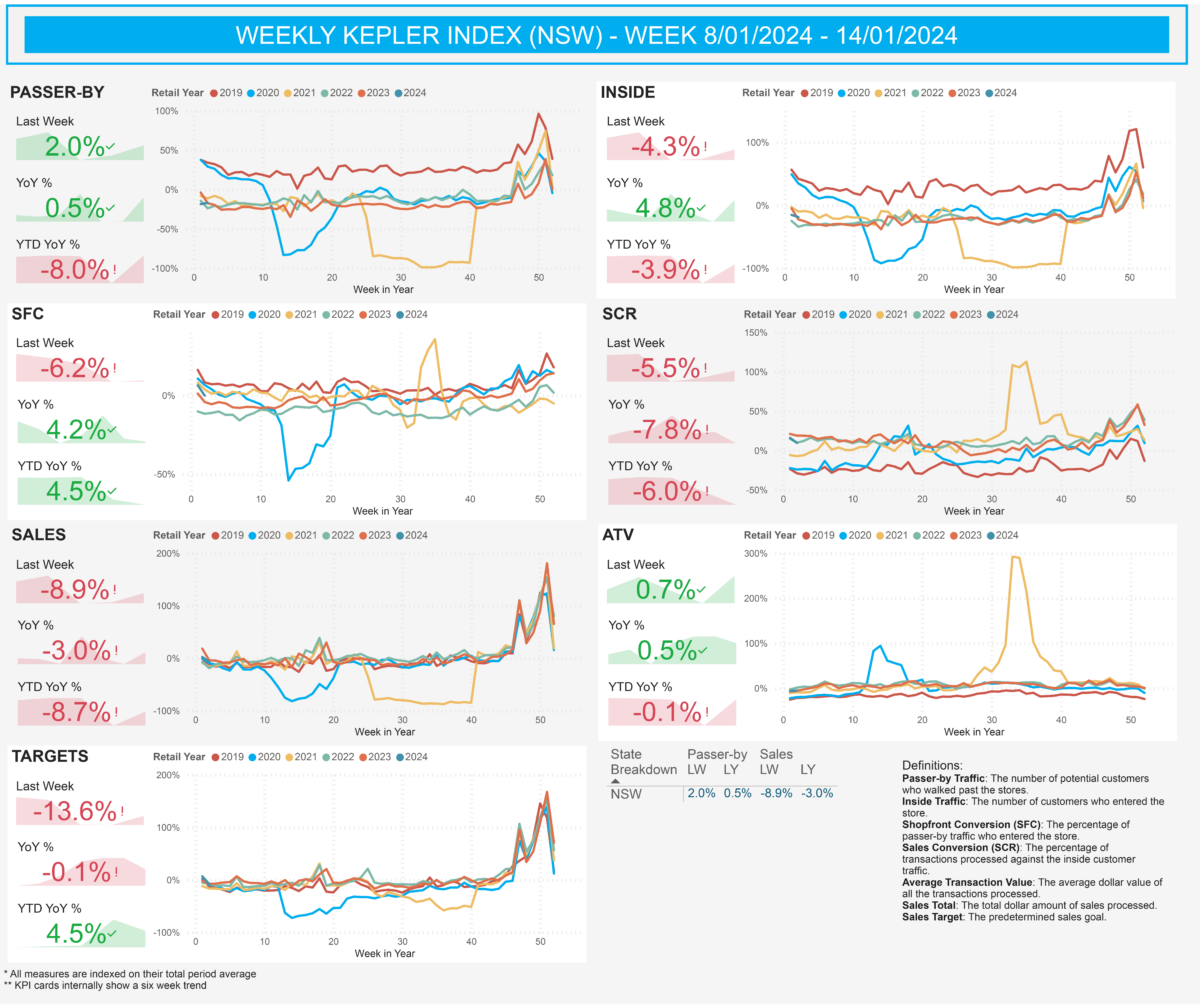

NSW

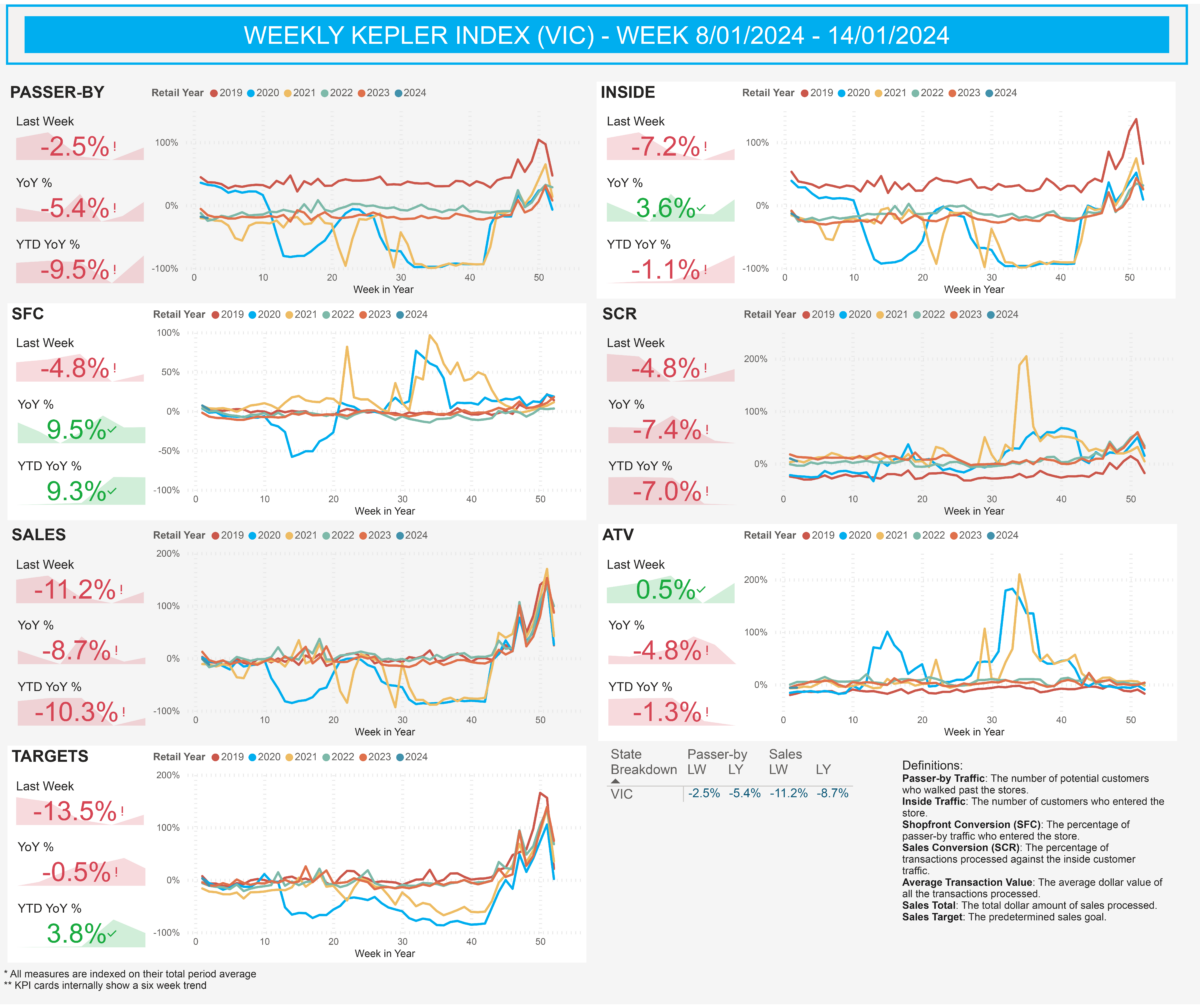

VIC

QLD

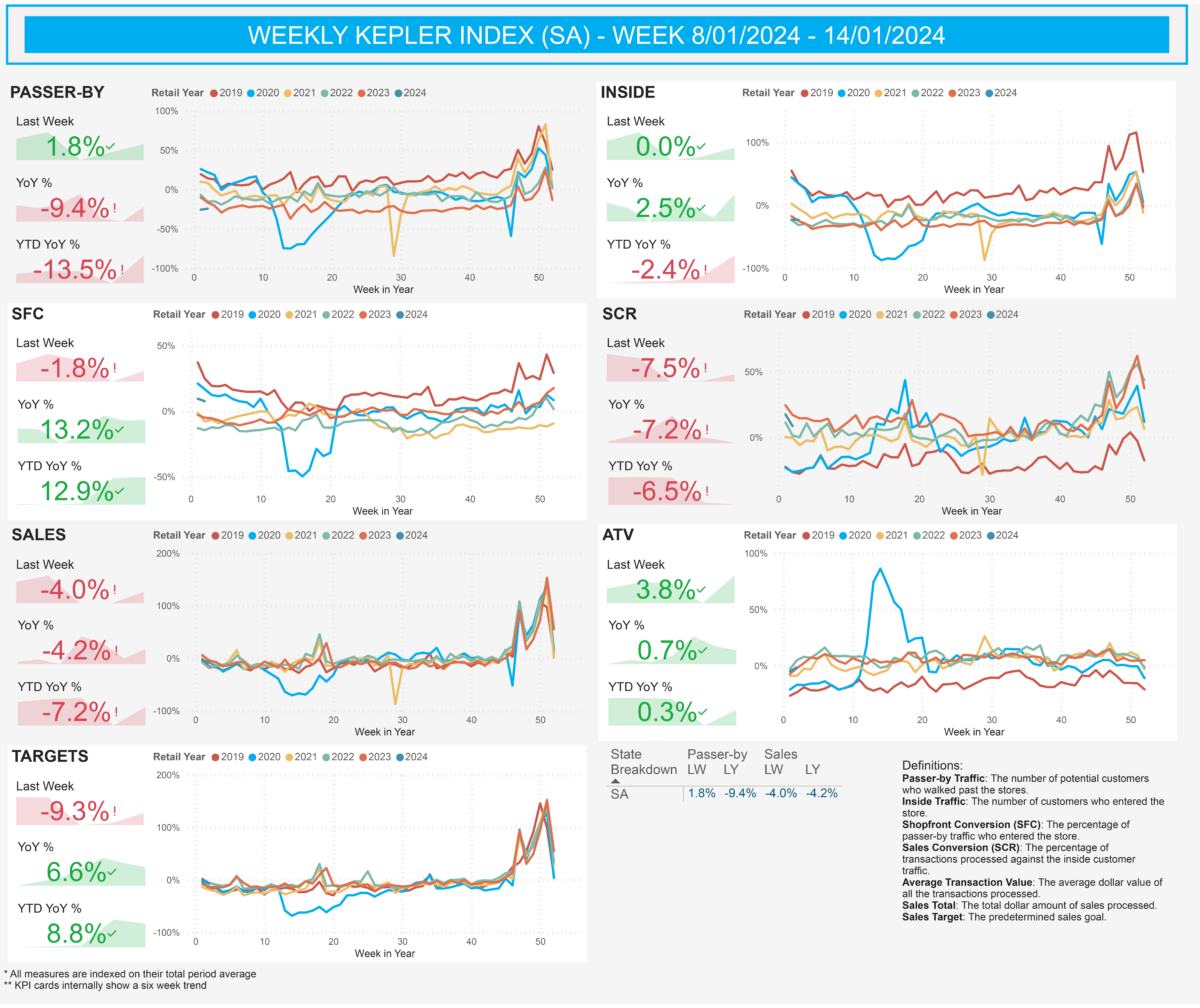

SA

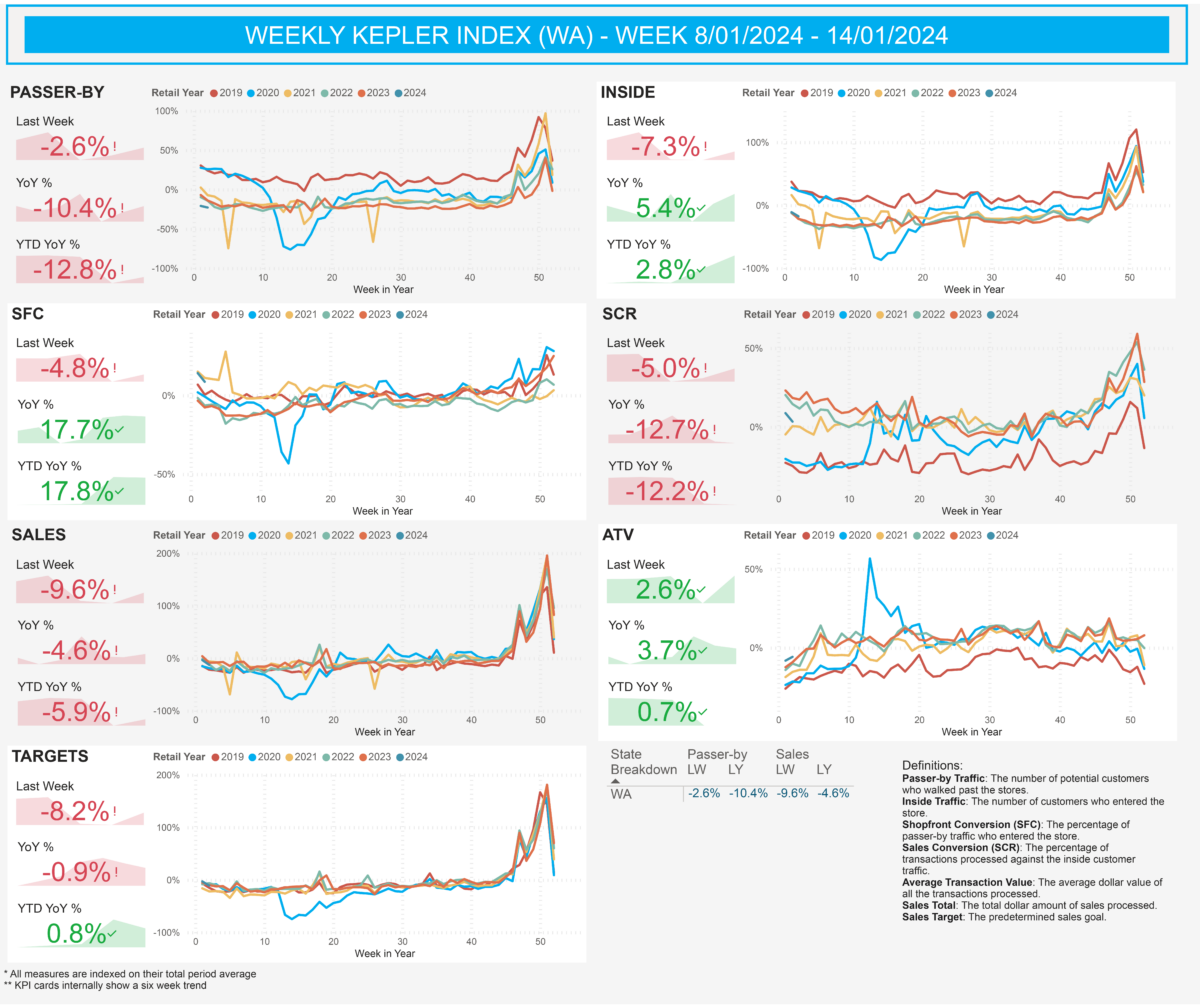

WA

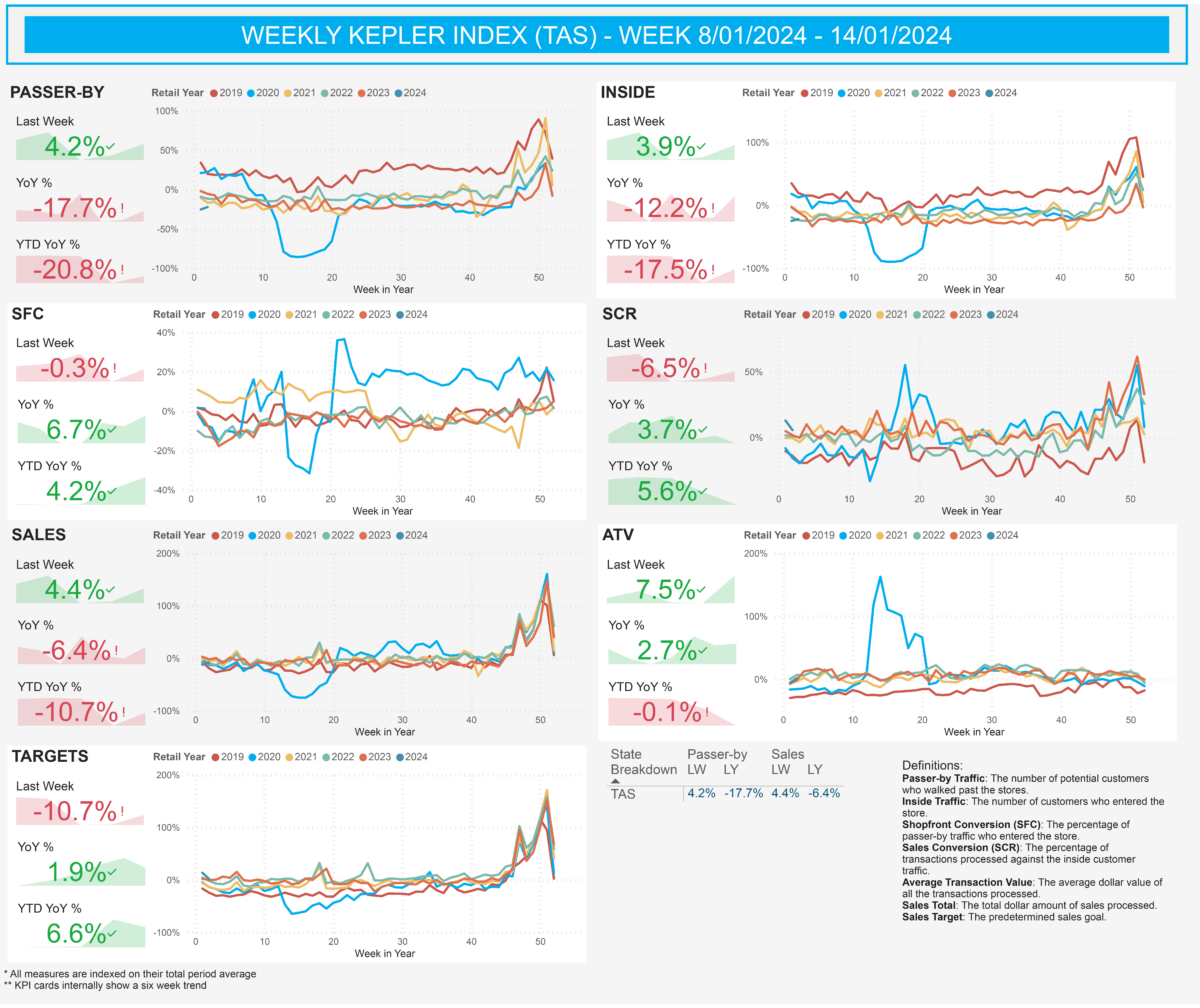

TAS

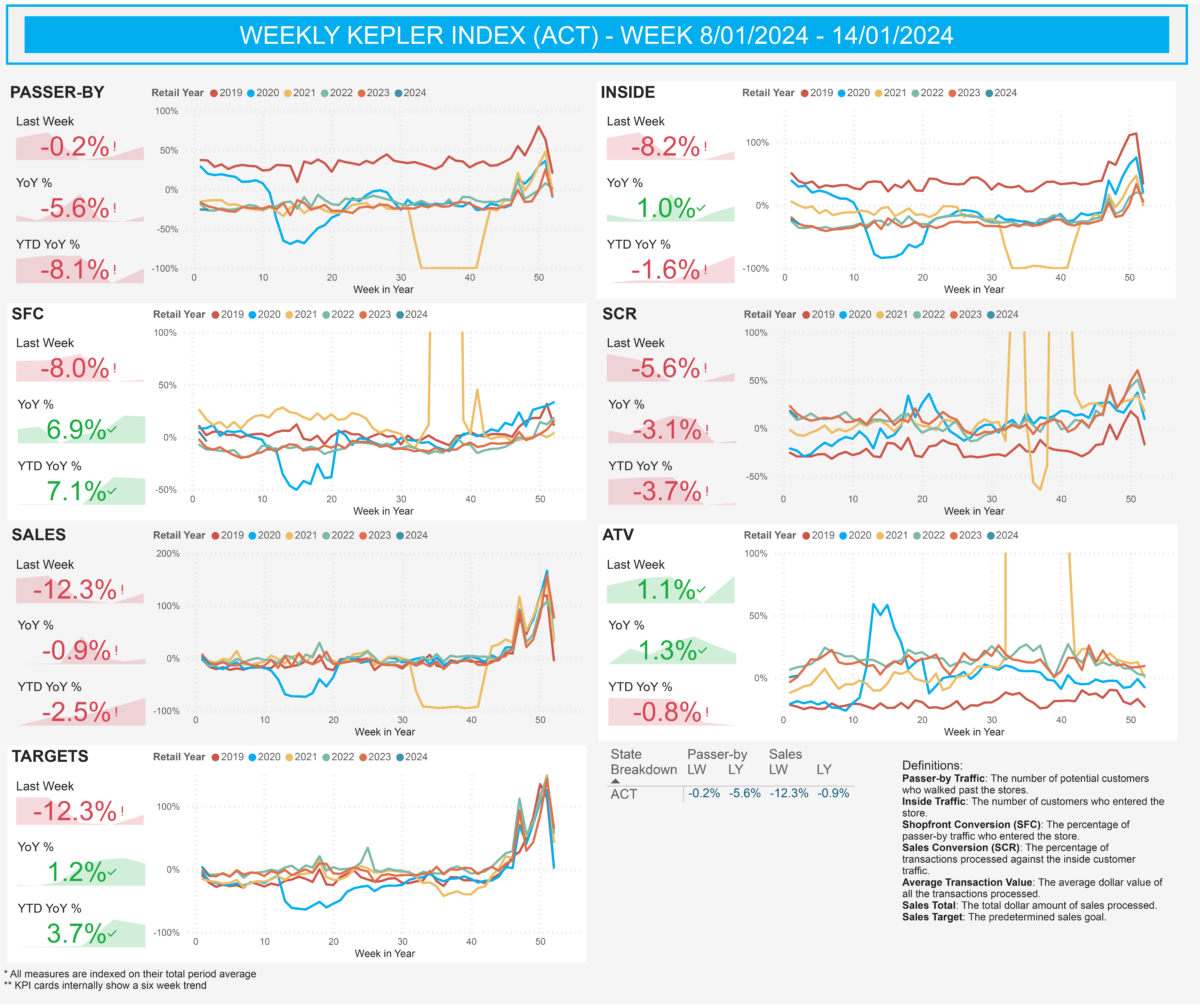

ACT

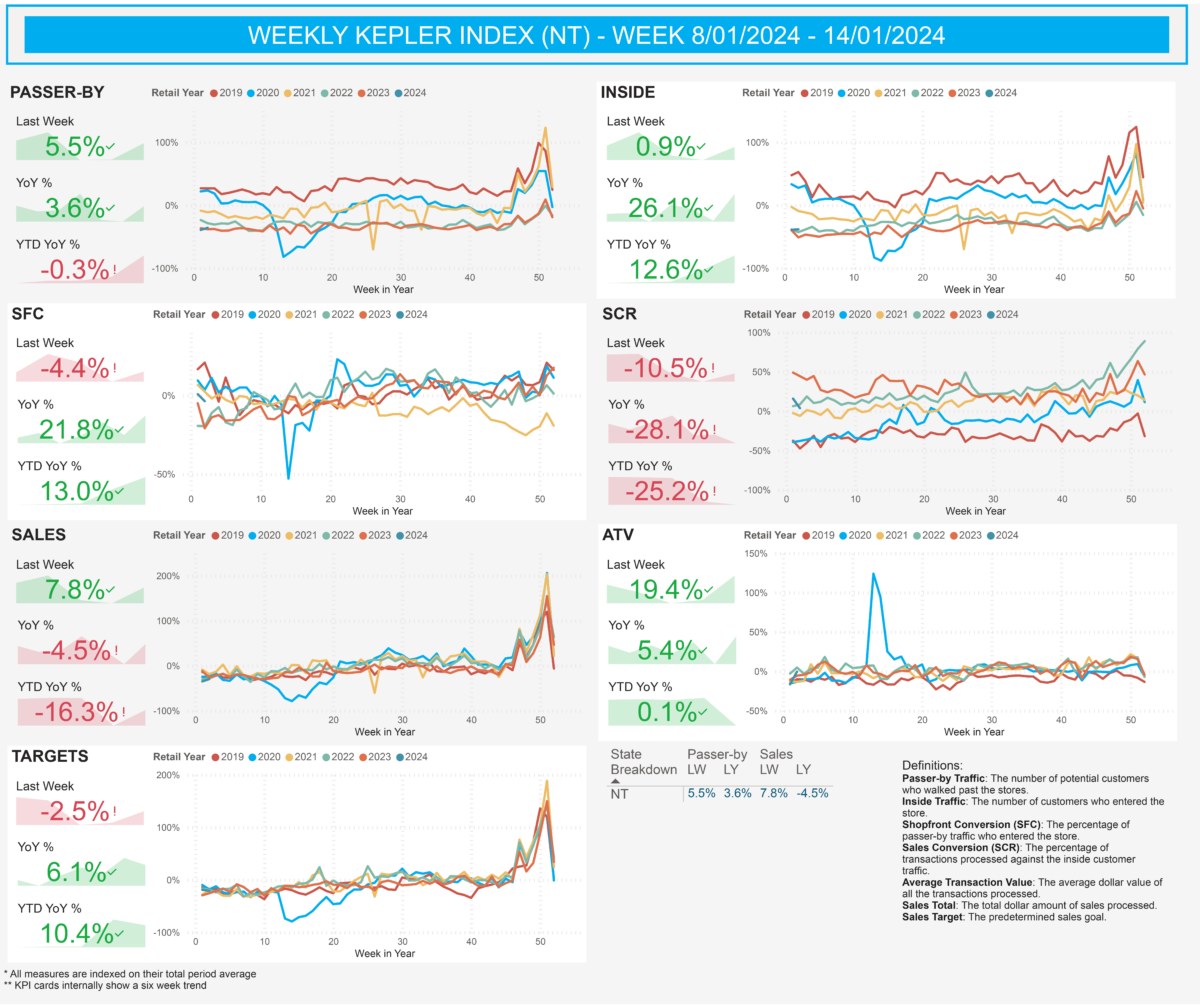

NT

Discover key insights in the latest KRI (Kepler Retail Index) update for the week ending 14/01/2024.

Strong trade in the week before Christmas, but weak Boxing Day sales.

- Sluggish early Christmas trade – Retail trading conditions in the 3 weeks from late November to mid-December (up to the week ending 17th December) were weak following the relatively strong Black Friday trading period in mid to late November. During this three-week period, passer-by traffic and sales were down 10% on the same period in 2022 indicating a cohort of consumers took advantage of the additional value on offering during the Black Friday trading period to bring forward their Christmas purchases.

- Strong last-minute Christmas trade – In the week before Christmas (18-24 December), last minute shoppers were out in force, driving an exceptionally strong trading result. Passer-by traffic was up 1%, inside store traffic was up 6% and sales were up 9% on the same week in 2022. The last time all three of these key retail performance metrics were up on the prior year was the week of Mother’s Day 2023. The product categories with the strongest growth in sales versus the same week in 2022 were Health and Beauty and Athleisure. CBD and Outlet locations continued to perform strongly relative to 2022 in this week before Christmas.

- Weak Boxing Day sales period – The positive momentum in the week before Christmas has not carried forward into the Boxing Day sales period, reflecting the ongoing financial pressure being faced by many households and the reduced spending capacity available following the Black Friday and Christmas period. Boxing Day week (26-31 Dec) saw passer-by traffic down a whopping 17.3% on 2022 with inside store traffic and sales down 7.1% and 8.2% respectively. The second week of the Boxing Day sales period (1-7 Jan) saw sales down even further (-9.8% on the same week last year). Last week saw some more positive results, with instore store traffic up 4.0% and sales down only 5.3%. However, a deterioration in sales conversion over the last three weeks has meant retailers are not fully capitalising on the available inside store traffic.

SAVE THE DATE

Join our first webinar for 2024 as I share more detailed insights on Australian Christmas and New Year trading conditions along with our retail outlook for 2024.

Tuesday 30th January

12.30pm to 1.15pm AEDT