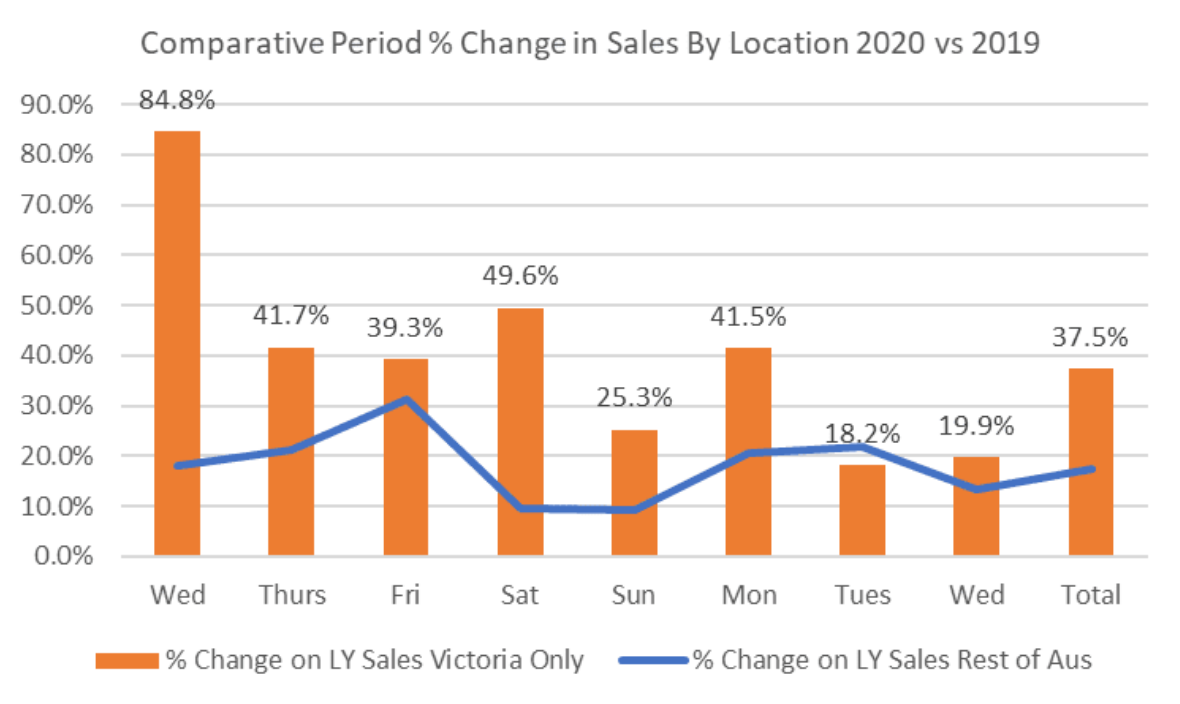

Over the first 8 trading days since the reopening of retail in Victoria, sales have performed very strongly. On a Like for Like basis, compared to the same days last year, stores have grown by a total of 37.5% – a huge result. Sales results have been strong Australia wide (excluding Victoria) up over 17% over the same period.

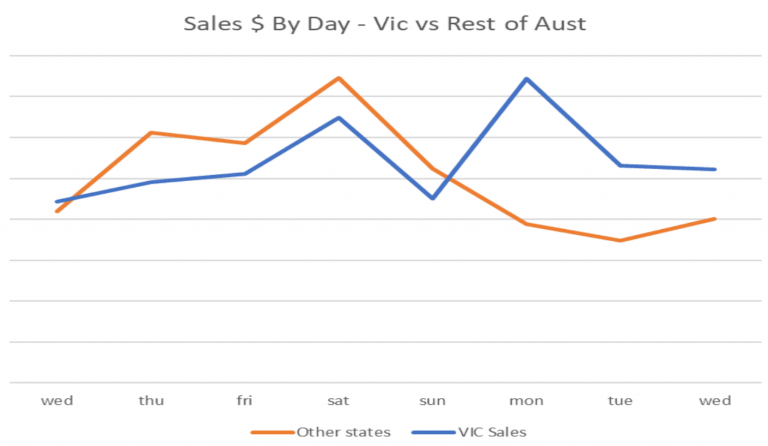

Sales in Victoria have shown extremely solid Year on Year, Like for Like growth each day. However the rate of growth has started to decline.

The first 6 days of reopened trade saw sales massively ahead of the remainder of Australian retail. The Monday leading into the Melbourne Cup Day Public Holiday saw a further huge boost to sales on prior year. However the rate of change on prior year tapered significantly. Whilst results were still 18% ahead of prior year on the public holiday, and almost 20% on the day after, this is a significant slowdown on the 40% or more increases across most days leading up to the public holiday.

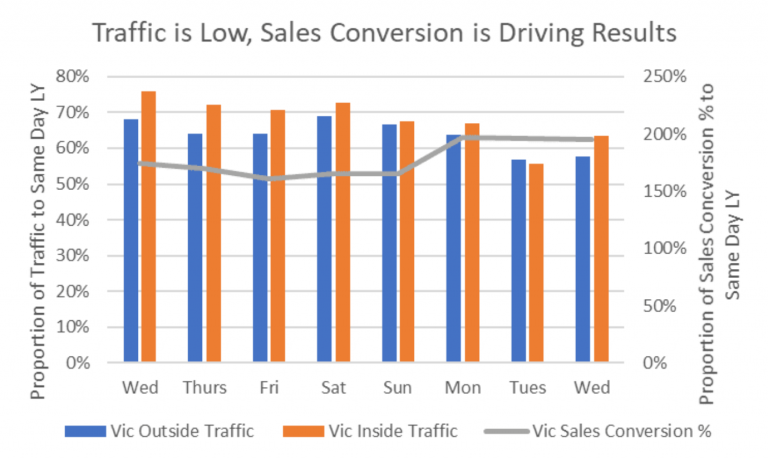

Sales Conversion is the Driving Force as Traffic Remains Low

The reason for growth is not traffic. Shoppers are not rushing back to the shopping precincts to browse and while away the day. In fact, “Outside Traffic” (the number of people passing retail stores) is down 30% to 40% on the same time Last Year. Similarly, Inside Traffic (the quantum of people that are entering stores) is down (though not as much).

We can draw a conclusion that the people in the shopping precincts are entering with more intent and “lists” most days. Shop Front Conversion is higher (the proportion of traffic entering stores as a ratio of those passing by). And Sales Conversion % is skyrocketing hovering around 180% for the better part of the first 8 days of trade.

Sales conversion has maintained these abnormally high rates for the duration of the 8 day period. Sales Conversion is running now at circa 54% vs 30% for the same time last year! Transactions have subsequently increased 25% despite the huge reduction in comparative period traffic.

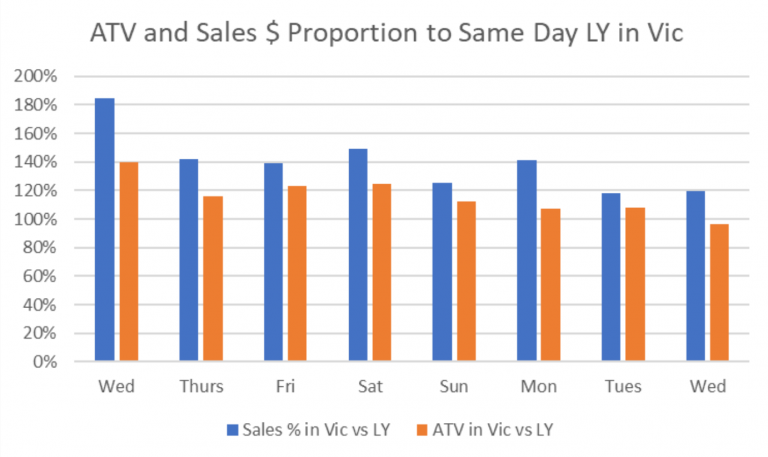

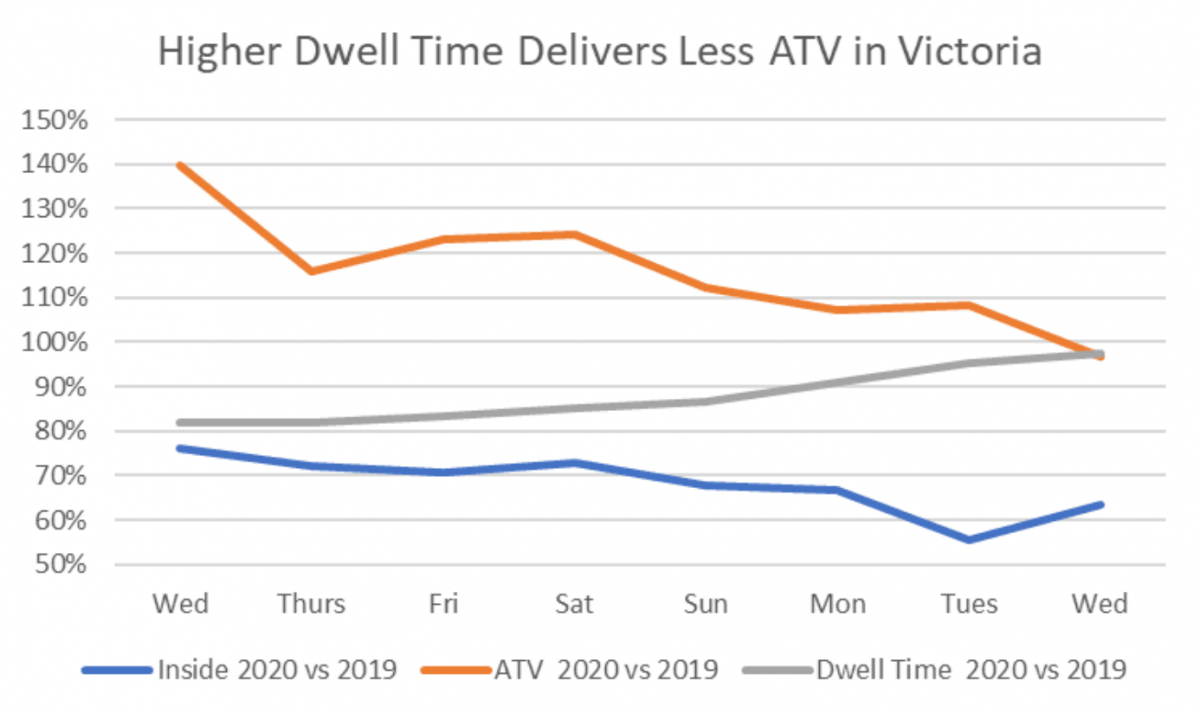

However, ATV is no performing as strongly. In fact, over the Mon 2nd November to Wed 4th November period, ATV had dropped circa 20% against the first 5 days.

The change in ATV is behind the decline in Vic stores rate of growth versus the rest of Australia, with Melbourne Cup Day Tuesday actually below the rate of Sales $ growth across the rest of Australia.

Although traffic is nowhere near LY, consumers’ pent up demand and ‘need to shop’ pushed up sales, but VIC consumers’ reactions to their pent up demand has been driven by SCR% but has been quickly weakened by a reducing need to spend big

In summary, VIC had a very strong reaction to store openings but this has been mitigated by a reduced need or capacity to spend big! Still want to spend (as seen in maintaining Sales Conversion %, but Reducing ATV $). The question is, are retailers leaving money on the table, or is consumer demand tapering?

Customers need rapid paths to purchase

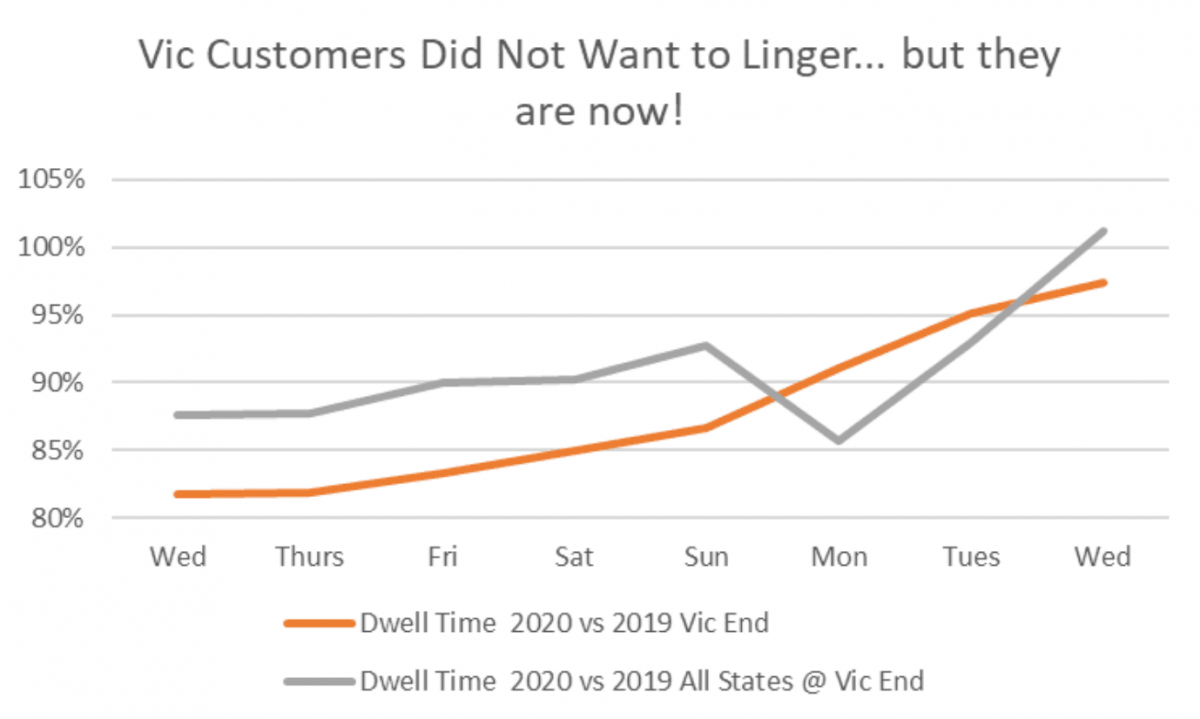

The change in Dwell Times might provide the indication of why VIC has seen a leveling off in sales. Dwell Time has been rising in VIC since re-opening compared to Other States. This is Indicative of stores having insufficient staff or stock causing shoppers to ‘work harder’ in store. As Dwell Time rises, ATV falls, and Inside Traffic struggles to rebound

Social distancing may have some role to play Perhaps this is a contributing factor to lower traffic but demand was and remains (as seen in high SCR%). However, Shopfront Conversion is 4.2% in 2020 v 4.0% LY in VIC which is not substantial enough to suggest hesitation in entering stores.

Victorian Store Dwell Time for the week starting2nd November is above or very near the National proportional change since 2019, and on the final day of the analysis, very near the same Dwell Time of a pre lockdown world last year.

The key takeout is this:

VIC stores are not optimising post Opening due to inability to upsell and service ‘willing customers’!

The key action points for retailers, particularly in Vic are:

- Have I structured my store operations to maximise Inside Traffic to Sales Conversion turnover, accepting that anyone who enters a store now, is more than likely to transact?

- Have I rostered effectively to ride the flow of transactions, or have I rostered for traffic?

- Have I retrained for, and recommunicated the need for speed in customer engagement?

- Have I equipped stores to replenish, reset and move quickly?

- Am I aware of the peaks and troughs by hour of customers, transactions, ATV etc? Am I able to quantify my opportunities throughout each day and react accordingly? (If not, call Kepler!)

- Am I continuing to stay in cooperative discussions with my landlords around traffic, and working towards Rent Per Outside, or am I stuck paying rent against my own sales?

There is a significant opportunity in the offing for retailers through the tail end of 2020. Answering these questions quickly and consistently will help you seize it.

Happy trading!