Click Frenzy (officially 10th to 12th November) is designed as a primarily online event. Savvy retailers continue to drive their promotions both in store and online, and have done so with success.

The reality is, traffic is stubbornly refusing to return to a pre Covid level. This leaves retailers with fewer opportunities to attract entrants into their stores. However, the use of online promotions seems to strengthen the hand of physical stores. Customers are still entering stores. And once their, Sales Conversion rates are almost double the same time Last Year. ATV is also significantly up.

By maximising cross-promotion opportunities, and by being able to physically service customers when they enter, a multi-channel retailer can drive significant sales growth for the year ahead.

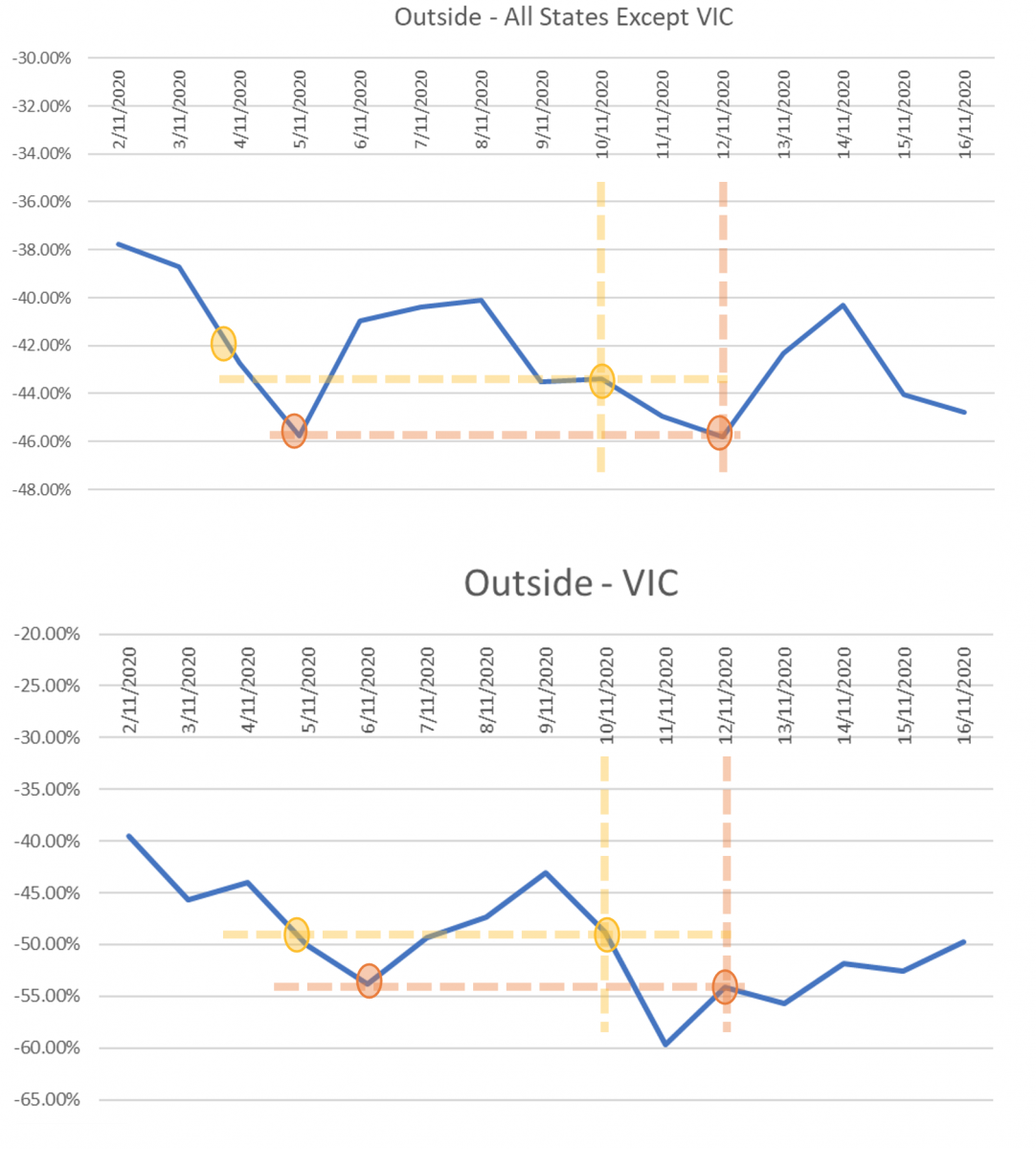

Outside Traffic – Business As Covid-Normal

Since Covid epidemics and lockdowns, shopping precinct in Australia has been stubbornly refusing to return to “pre Covid” normality. Kepler has been reporting significant declines of 40% to 50% on prior year Australia wide. Victorians have also not rushed back into shopping precincts despite elongated lock outs.

So one might have expected that Click Frenzy would have driven even more customers from “bricks and mortar” spaces and into online shopping realms. And whilst traffic was sharply down on prior year for the same DAY of trade, what is noticeable is that it really wasn’t significantly different to a new Post Covid period. The only noticeable variant is on 10th November was traffic was a further 2% lower than same day of the prior week – 44% down versus 42% down the week earlier.

The difference if any is that the pattern of behaviour post Click Frenzy is changing. In Victoria, customers seem to be slowly and gradually inching their way back to 50% down on prior year, whilst the rest of the country shops through the weekend at circa 40% below last year before

Data shows percentage (%) change vs last year.

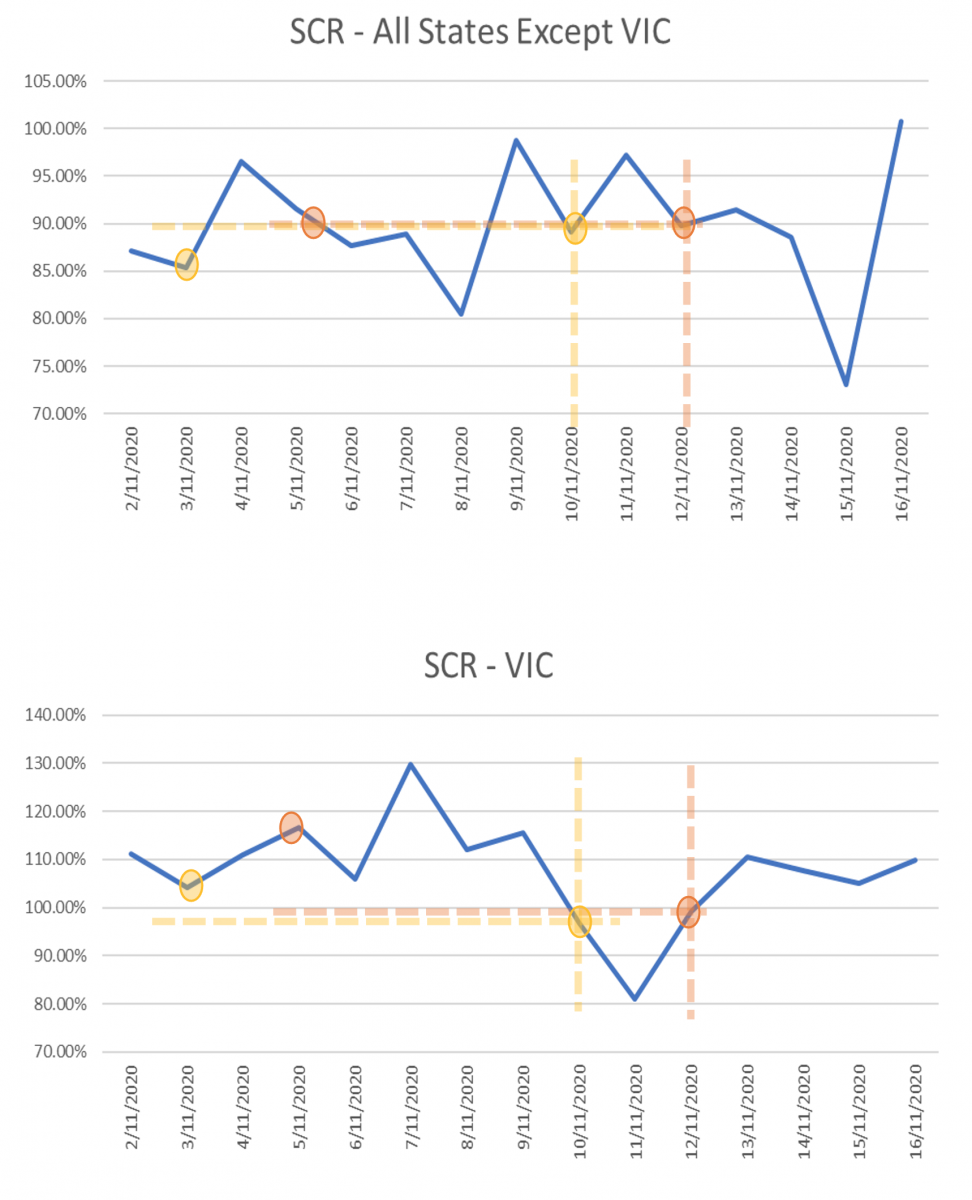

Sales Conversion Holds in Australia but declines in VIC

Sales Conversion rates did tend to diverge between Vic and the rest of Australia (South Australians may want to take extra notice here). Whilst in the rest of Australia, Sales Conversion % maintained its trajectory at nearly double the rate of same time last year, up circa 90%, Victorian Sales Conversion % was lower in Click Frenzy from the same time the prior week.

It is worth noting that the Sales Conversion rate in Victoria is well over double the same time last year.

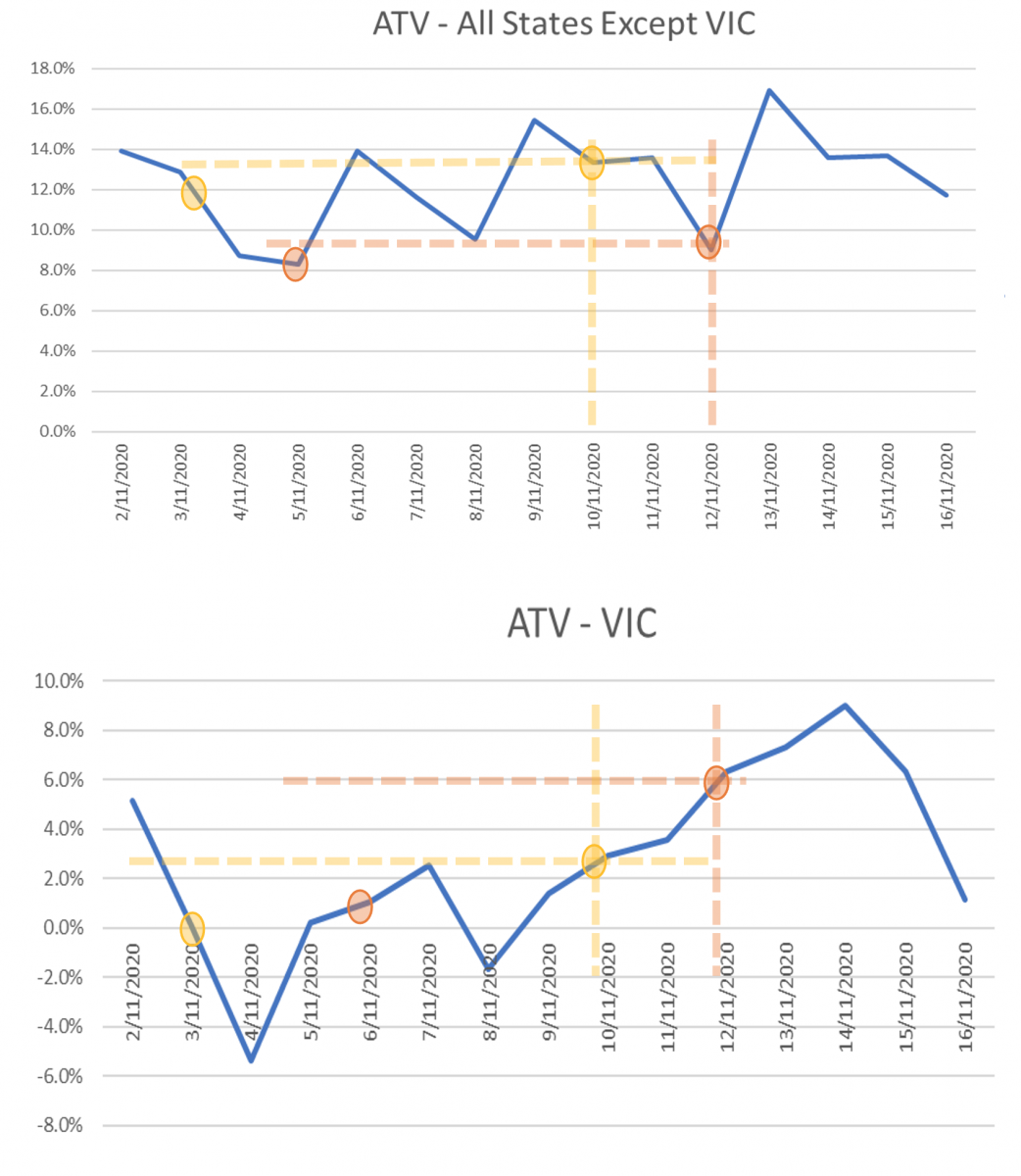

In Store ATV Increases Dramatically during Click Frenzy

As a counter point, we note that Average Transaction Value in store is not only significantly higher in a Year on Year review, but the Click Frenzy promo drive ATV higher in store also.

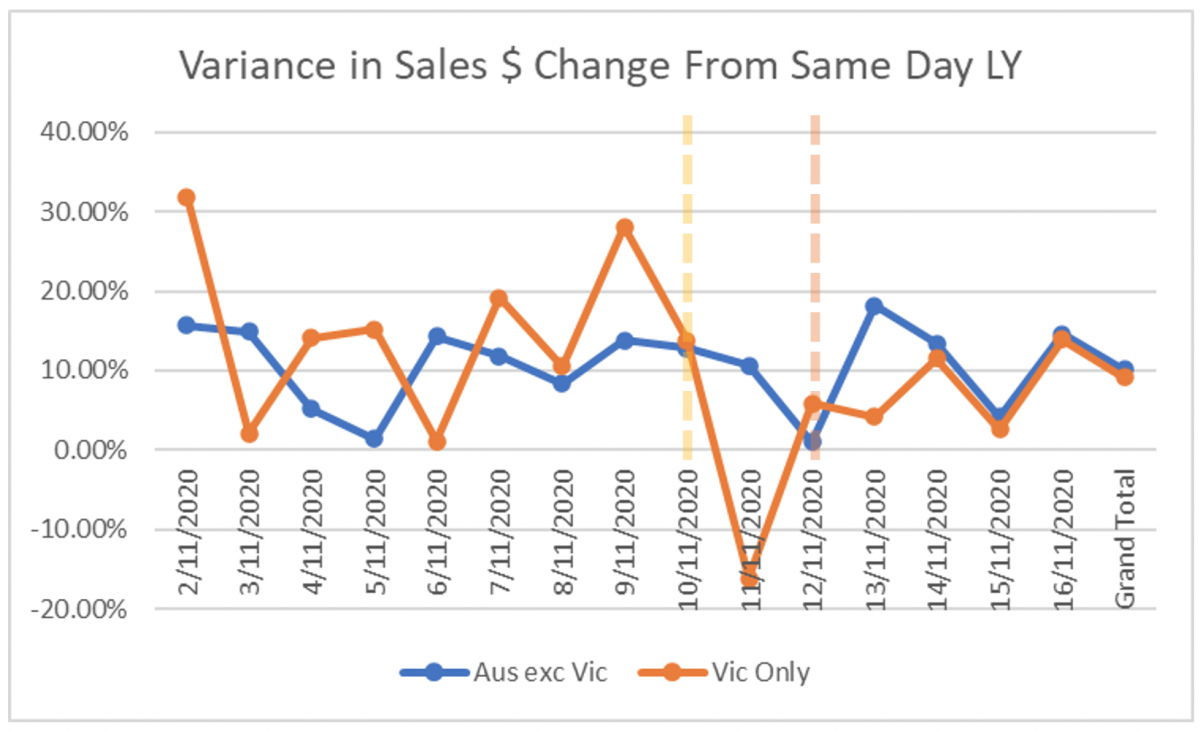

Sales $ are Strong and $ Growth Continues

The all important Sales $ return for stores was also almost unaffected by Click Frenzy. Bricks and Mortar retail has been solidly growing year on year, on a Like for Like basis. Victoria suffered on day of significant decline on Last Year results and the rest of Australia showed minor growth of 1% on 12th November. But cast your mind back to mid 2019 to put a 1% growth rate into perspective. For many, this is streets ahead of typical year on year results.

Conclusion

The end take outs are simple and reaffirm what we have been seeing for some time:

- The growth in Brick and Mortar stores remains strong. Whilst an Online-focussed event may have a short term impact, these are temporary and not always negative

- The combination of online and real-world promotions continues to drive sales in retail environments. Extending this mix of opportunity and promotional presence is critical to long term, sustained sales growth.

- Traffic remains stubbornly low in centres. Customers are yet to commit to shopping precincts at 2019 levels. However those that remain are very keen shoppers and are in store to transact. They also spend significantly more per transaction.

Savvy retailers will be lining up support, resources, merchandise and in store activations, with their online points of presence and exposure. Any entrant into a store is there to shop. Abandoned baskets in store should be a thing of the past for the foreseeable future.