Download Full PDF Report

Key Insights

Easter in 2021, provided the strongest sales results of recent years, with Sales $ up 11.3% on 2019 figures.

Whilst continued reduced ‘Inside Traffic’ levels indicate that sales results may be challenged, there is still room for optimism, with seasonally adjusted figures showing growth.

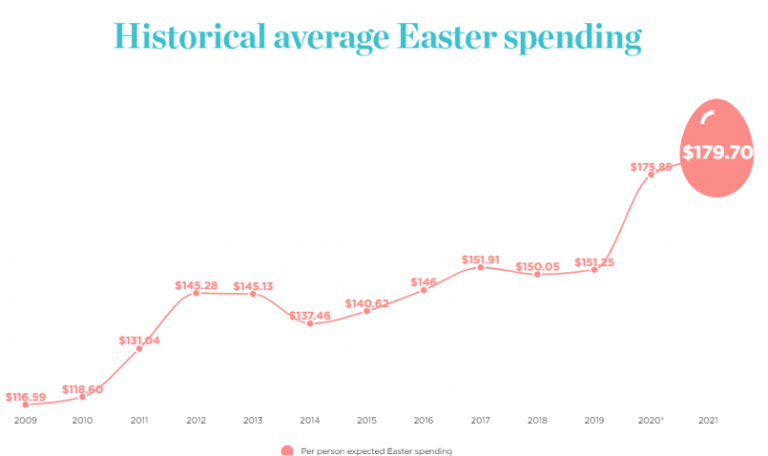

Consumer patterns have shifted, with key retail trends from the USA showing higher per-capita spend at Easter and this incremental spend moving towards gifting and fashion categories.

Click on the images to enlarge

Easter in AUS & NZ – Pattern of trade and drivers of sales in recent years

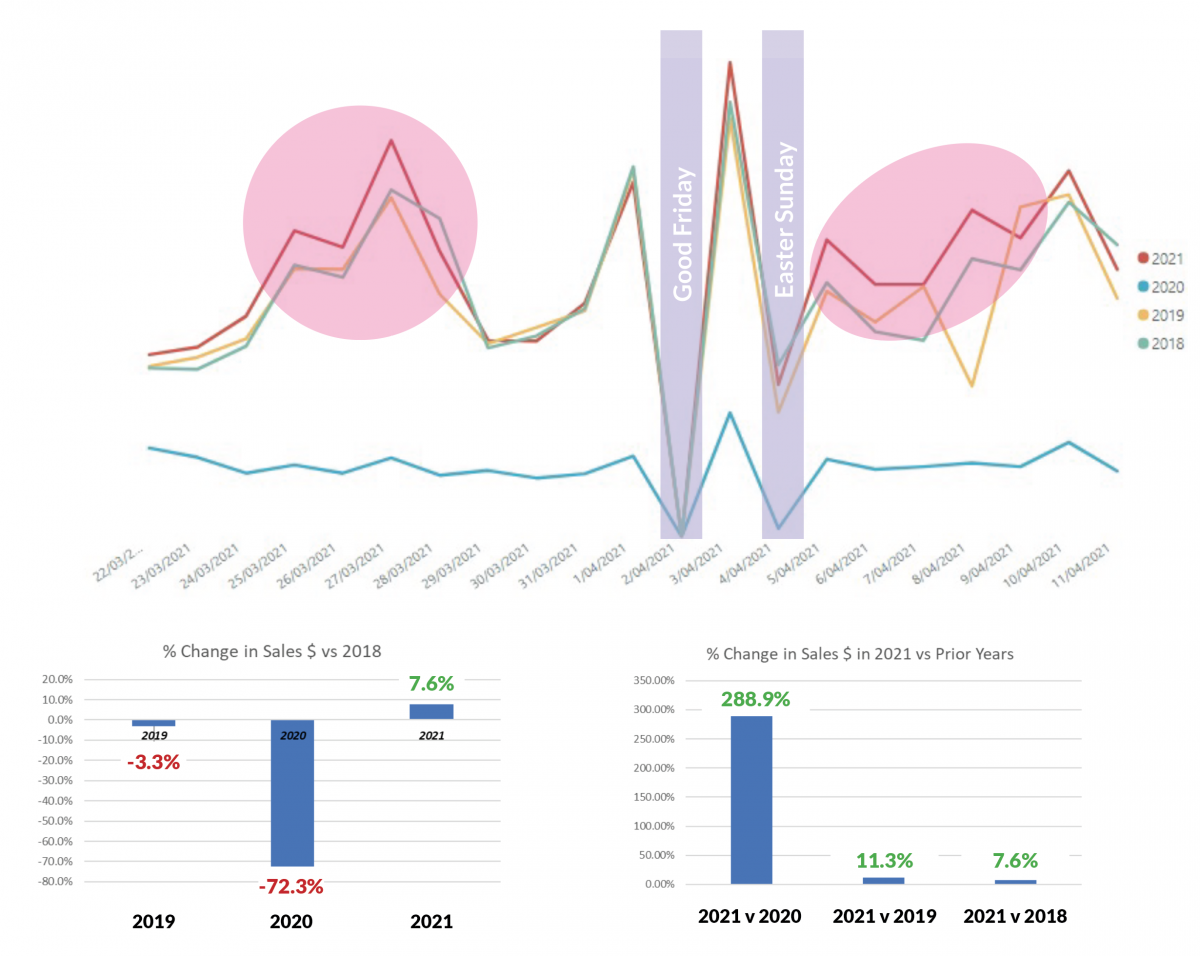

Using a baseline of 2018 Easter period sales, the results from 2021 saw a strong rebound from two years of decline.

Sales $ in 2021 increased vs 2019 by 11.3%, which compares very favourably to 2019 result of -3.3% compared to 2018.

Sales $ in 2021 were ~290% higher than 2020, as lockdowns took their toll on retail in 2020.

Sales $ increases were mostly generated 7-10 days prior to Easter Sunday, and 2-4 days after Easter Sunday.

Sales Conversion Trend and Timing

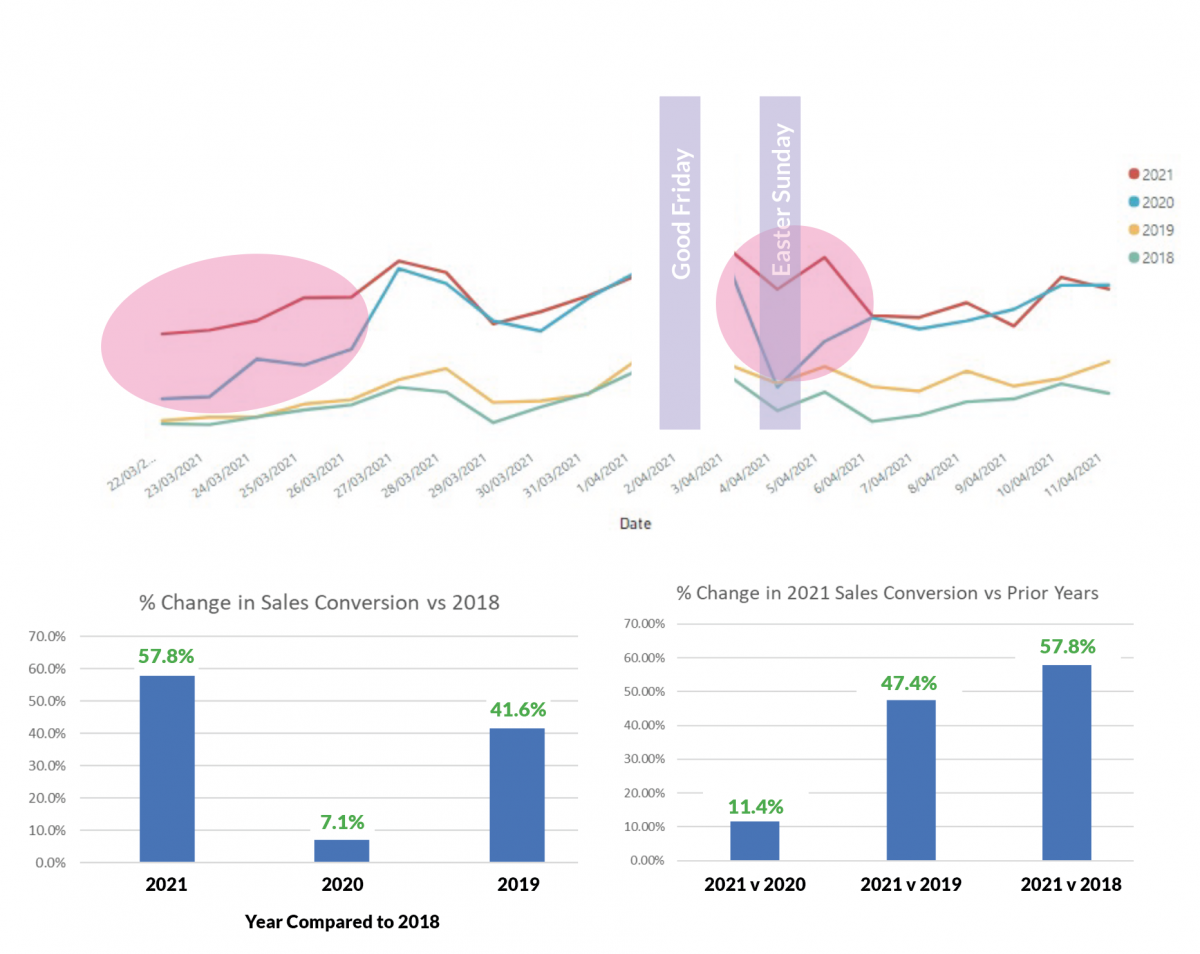

Sales Conversion has been steadily increasing each year.

Sales Conversion during Easter 2021 was almost 50% higher than Easter 2019, and over 11% higher than 2020.

Note the Sales Conversion increases were almost entirely due to changes in purchase behaviour in the early stages of the campaign, and the immediate proximity of Easter Sunday itself

Australia Post Transactional Data

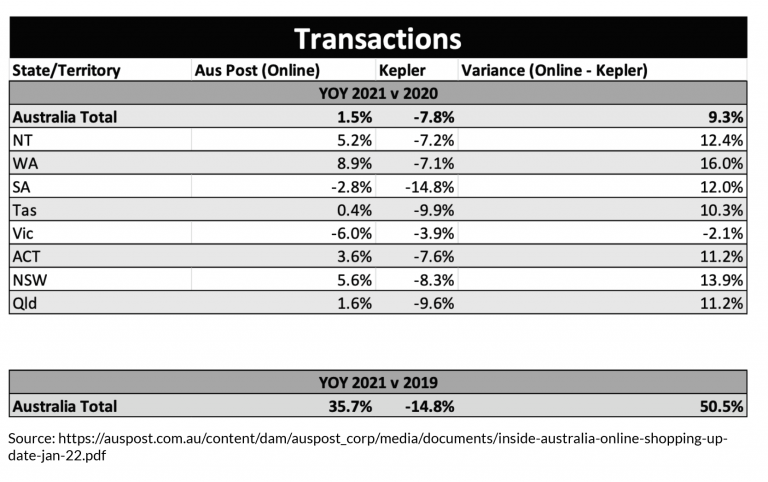

With Easter emerging as a gift giving time of year (see later for long term USA trends), a comparison to transactional volumes from the Christmas gifting period may provide some foresight as to transactional volume expectations.

Australia Post compared its ‘Online Shopping’ parcel deliveries in December 2021 vs 2019. We have taken these rates and compared them to the Kepler Transaction count change for the same time period.

Whilst ‘Sales Conversion’ and ‘Sales $’ are up in bricks-and-mortar stores, the traffic declines are seeing a transactional variance leading to more online shopping. As an indicative trend, the cautionary notes we have previously raised on stock levels, staffing and capacity for brick-and-mortar stores remain.

USA Category Trends

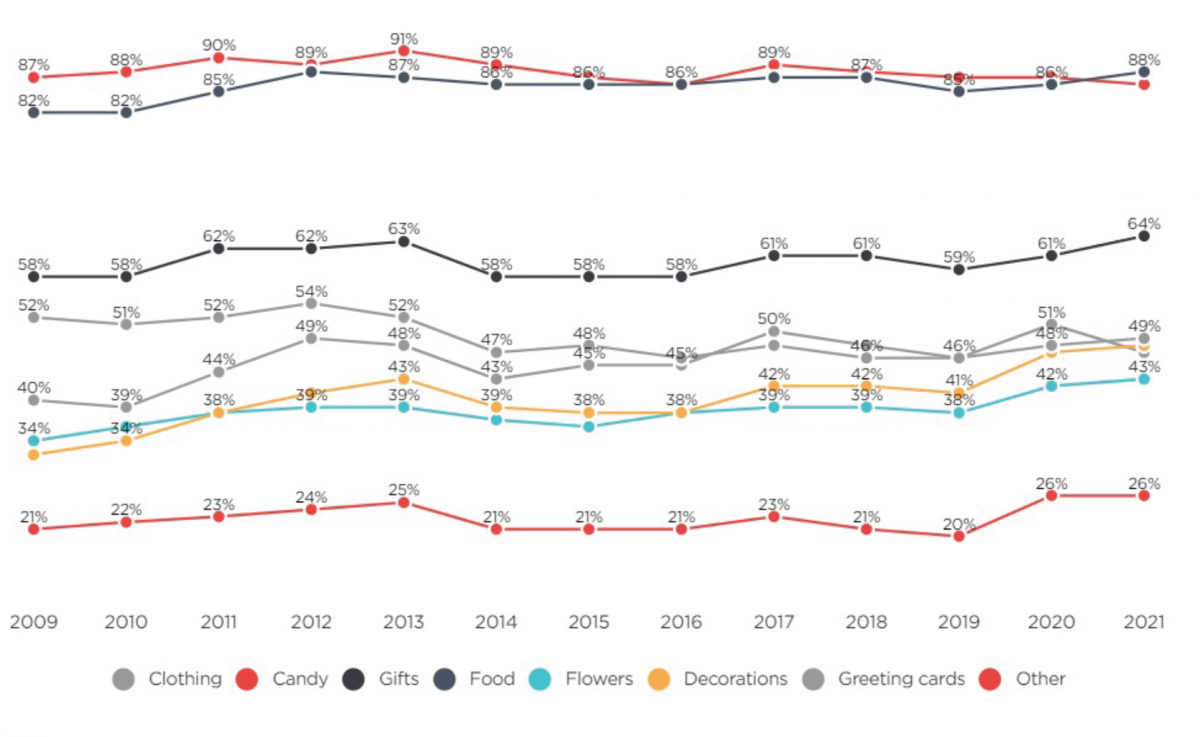

Whilst Candy (read Chocolate in an Australian context) remains an almost universal gift choice at this time of year, categories such as clothing, gifts and flowers have all seen purchase plans increase dramatically since 2009.

The increase in non-food treat gifting categories is coming from an overall boost in spending, rather than a shift in patterns of purchasing.

Source: https://nrf.com/insights/holiday-and-seasonal-trends/easter/easter-data-center

Source: https://nrf.com/media-center/press-releases/average-easter-spending-expected-be-highest-record

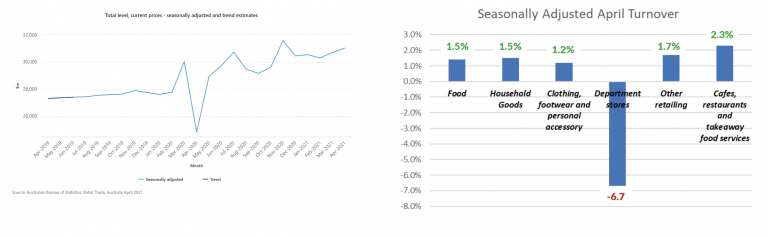

ABS Trends

Australian Bureau of Statistics results confirm that sales have been steadily rising in real terms with spending in most categories rising in seasonally adjusted terms

Location Trends

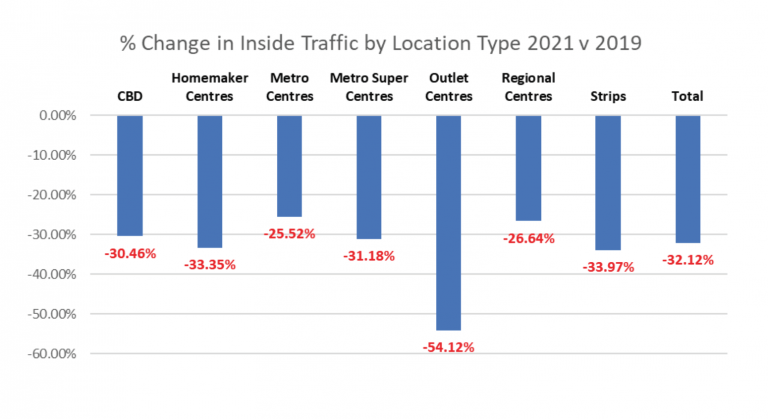

‘Inside Traffic’ expectations remain cautious for 2022 with most retail precinct types continuing to deliver reduced ‘Inside Traffic’ to stores.

In 2021, Metro Centres and Regional Centres were best able to minimise the reduction in ‘Inside Traffic’. Outlet Centres delivered less than half of 2019 ‘Inside Traffic’ to stores in 2021.

Inside Traffic Trends vary by location type

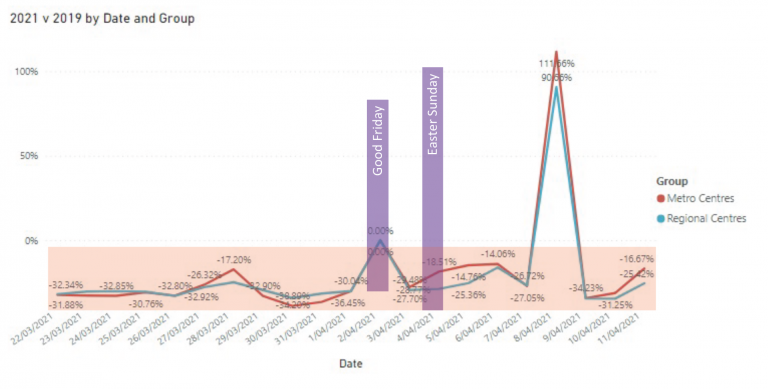

Metro and Regional

Savvy retailers will note that different shopping precincts have different trends, with Metro and Regional Centres both showing relatively consistent declines over the period versus 2019 – with one very solid rise in the post – Easter window.

Metro and Regional

Savvy retailers will note that different shopping precincts have different trends, with Metro and Regional Centres both showing relatively consistent declines over the period versus 2019 – with one very solid rise in the post – Easter window.

Homemaker Centres + Outlets

Homemaker Centres and Outlet Centres both exhibit significantly deeper declines than Metro and Regional Centres, but there is a distinct improvement in results after Good Friday in each of these locations – in store approaches should reflect this shift.

Inside Traffic Trends vary by location type

Retailers should prepare for the decline in ‘Inside Traffic’ to continue versus pre-pandemic levels.

This will lead to lower in-store transaction levels.

However these changes are neither uniform in retail sector, nor retail precinct.

Gifting and Apparel retailers (and probably Homewares also) should be conscious that consumer incremental spending is likely to be directed at them.

Customers are also more likely to pursue “broad retail” centres in both metro and regional areas, with a touch more traffic likely to return post Easter to Homemaker and Outlet locations.