Data below is representative of Australia only. If you would like retail insights on other regions please get in touch with us at info@kepleranalytics.com

For retail, a somewhat exciting (and relieving) time as Australia brings into play its first full year baseline comparison since 2019.

Since then, much has been speculated as to what the future holds for retail post-COVID in Australia. With complex and varying factors in play and continuing to evolve, having a concrete starting point of data and market insights is vital to strategise plans. Utilising actual retail store captured data provides a factual base to understanding these real shifts better arming retailers on how to practically respond to these shifts.

- Compared to pre-COVID years, a 40% decline in stores inside foot traffic offset by a significantly improved sales conversion and average transaction value is the new retail landscape that has shaped retail in Australia

- Sales up on pre-COVID years however inflationary pressures throughout value chain erode retailer profits

- Traffic this Christmas expected to still double from its Jan-Oct average weekly traffic baseline

- Increasing Shopfront Conversion (SFC) should be the goal of all retailers this festive season. Shoppers remain very purposeful, and willing to transact. Bringing as much traffic into store as possible into store represents the greatest opportunity.

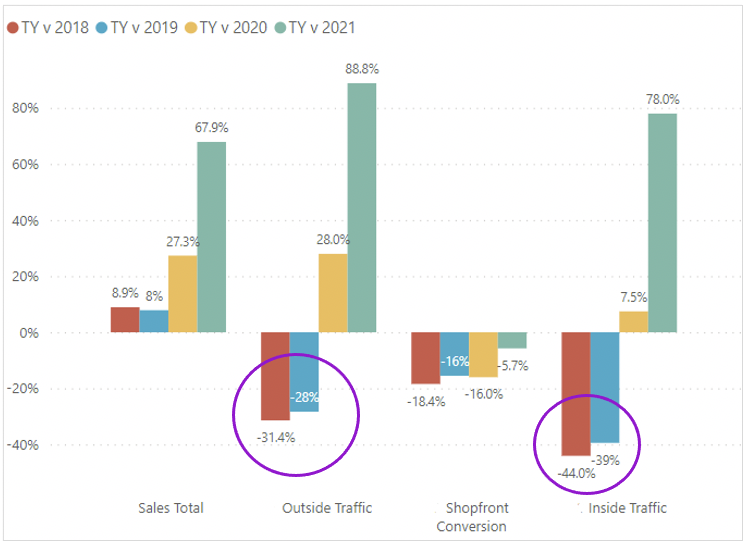

Retail traffic flow evolution

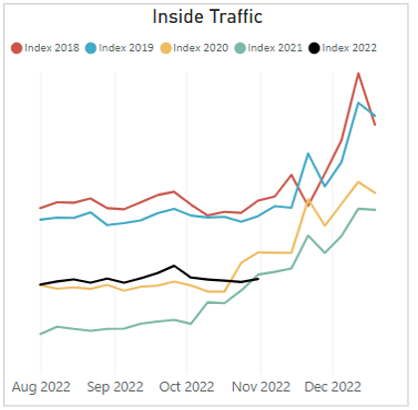

Below shows a 4-year comparison of the period leading into Christmas (Aug to early Nov), we clearly see a shift to pre-COVID that has re-shaped retail in Australia to ultimately drive favourable sales to pre-COVID levels.

- Outside Traffic remains unfavourable compared to pre-COVID – but seems beyond the worst of the declines

- Inside Traffic is even worse – despite the end of lockdown behaviour, stores are still starved for traffic

- Shopfront Conversion is trending better but still negative – the objective must be to close this gap before competitors do

Note: comparison metrics to 2020 (yellow) and 2021 (green) are impacted due to state-based easing of COVID lockdowns through this period.

Comparisons to pre-COVID periods 2018 (red) and 2019 (blue) show a clear shift in the retail traffic flow with a 30% decline in outside traffic combined with a 17% decline in shopfront conversion resulting in 40% decline in inside traffic.

This essentially leaves it up to retailers the job to drive more consumers in from branding, customer experience, customer loyalty or promotion all of which are expensive and impact their bottom line.

Opportunity: Shopfront conversion (SFC) will be key. Leveraging the traffic flow generated from other competitors marketing into your stores will return additional revenue. Becoming crafty in this space may provide that uplift required over the period without as heavy investment.

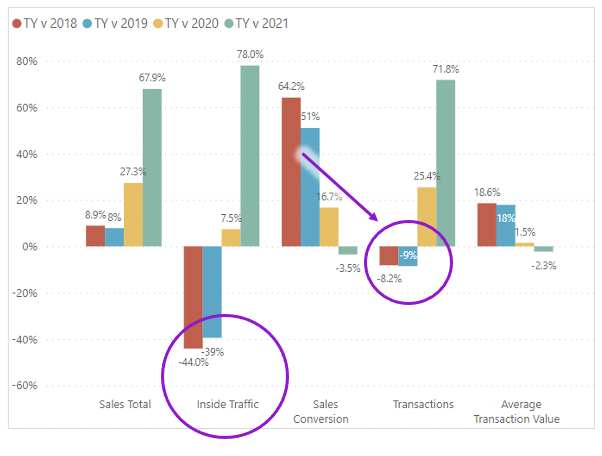

Retail performance metrics shifts key to holding sales

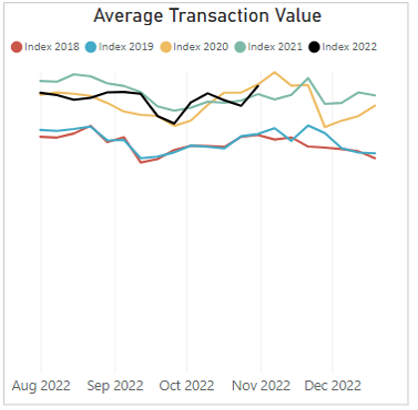

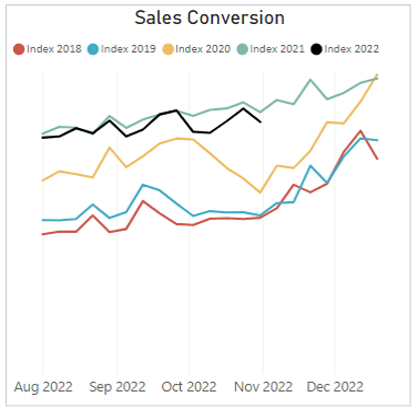

The significant declines in Inside Traffic are offset by strong Sales Conversion however it is trending backward to prior years which increases the intensity of the headwinds. This underscores that every visitor to store is a real opportunity to convert and increase basket spend.

An increase in Average Transaction Value by 18% has offset Transactions decline and resulted in an overall sales lift of 8% pre-COVID.

However, retail sales growth has exceeded retail sales volume growth reflecting the role price increases have made to support retail revenues. With inflationary pressures included it paints a tough picture for many retailers’ bottom-line performance.

Opportunity: The importance of having stores adequately staffed to convert sales is vital in addition to increasing transactive capacity through combination of store, staff, fixtures, ticketing, ambience, navigation to increase customer propensity to purchase.

The need for retailers to invest in analytics solutions that both enable visibility of in-store consumer journey as well as rostering optimisation to unlock more transactive capacity and reduce costs will be key not just this Christmas but into the future. Reach out to Kepler if you require more information

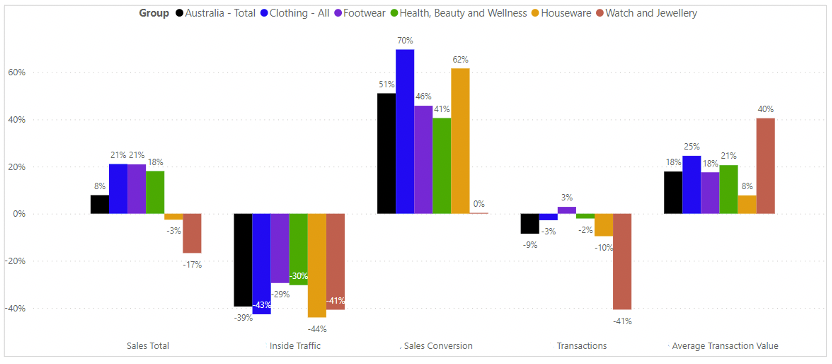

Category Performances – Clothing the standout

Although ^25% of online transactions are Fashion/Apparel related, Apparel is the standout performer for retail stores comparative to pre-COVID periods with a 70% increase in Sales Conversion driving the sales uplift.

Sales Conversion remains strong compared to pre-COVID leading into Christmas with retailers better equipped to convert or have better branding to deliver more pre-disposed customers to store (or both as we expect).

Overall, all categories have recovered sales with exception of watch and jewellery where Sales Conversion has remained flat against other categories.

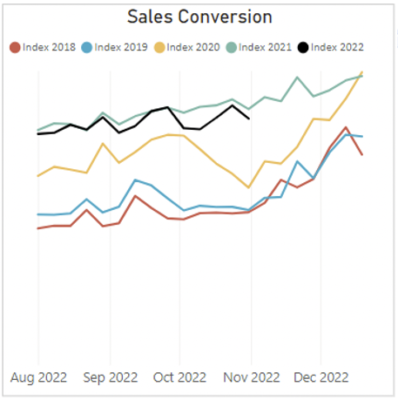

2022 Lead up to Christmas

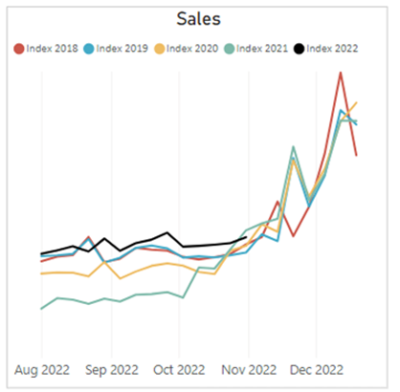

Like-for-like sales trends below for 2022 shows an overall strong sales lead up to Christmas. 2022 sales trajectory now mirrors the pre-COVID sales trajectory (red and blue lines) suggesting a healthy lead up to the Christmas period. Retailers will need to prepare themselves for once again the doubling of foot traffic come December and optimize the peaks.

With supply chain pressures easing and retail inventory levels healthier than 2021 this sets up the Christmas period as the opportune time to continue the +8% sales growth. Maintaining the strong sales conversion and average transaction value that will be essential for this to materialize.

Opportunity: ATV is inline with prior years despite CPI and price increases implying basket size is falling or retailers are discounting further. Promotional timings and targeted discounting depth and extent of ranges are even more critical not only for December but for stock position in 2023.

Other impacting factors

The reshaping global retail market at differing times over the last 12 months and have been in the recovery phase. Australia has seen a relatively steady trend in recovery compared to other markets thus far. However, looming ahead in Australia as well as other markets is uncertainty on inflationary and other economic pressures that we will likely see a lag impact on retail discretionary spend. In addition, the record level consumer savings levels in Australia are now seeing a turn suggesting that consumer savings spend is overcompensating for some of this positive sales trend we are currently witnessing.

In addition to the evolving landscape, many experts have cited we are seeing a turning point for retailers as consumers move to services spending. This is yet to play out but will be an important dynamic to monitor.

The dynamic between online and stores continues to evolve and although online has increased share of retail spend over the last 2 years, online sales overall and their share of retail spend is now normalizing. Online retailers have been able to increase shopper frequency and create more returning customers through simplifying the shopping experience and ease of use improvements. Additionally, the channel has made significant improvements to online fulfilment and distribution – watch out for another gradual increase in online activity as this channel innovates and increases service levels following the likes of Amazon.

What’s next

With sales from many retailers back to pre-COVID levels, landlords are likely to demand higher %increases ignoring the increased CODB impacts absorbed by retailers.

Kepler has often stated that what retailers buy (foot traffic) is not what they are charged for (space and sales revenue). These two positions are now in stark contrast – with Sales growth being underpinned by price rises and retailers better aligning themselves to consumers BEFORE they visit centres. Space itself, is only as valuable as the revenue-generating potential of the traffic that enters the store.

We have received significant feedback from clients that property will be a key focus for 2023. Aligning rent to the traffic, as well as the space and sales value of the store will create a new vista for many astute retailers as the challenge of renewals surface, we agree. The volume of traffic has changed dramatically. As have their consumer habits and movements in centre.

As retailers seek to control costs, rentals appropriate to traffic will be a key driver of portfolio management in 2023 and beyond.

Reach out to Kepler if you require additional insights or detailed analysis on traffic in your locations.