Download Full PDF Report

Key Insights

In the week leading into Valentine’s Day is the 7th highest Sales $ week in the 44 weeks preceding November. Traditionally, Watches & Jewellery have dominated consumer spending during this week.

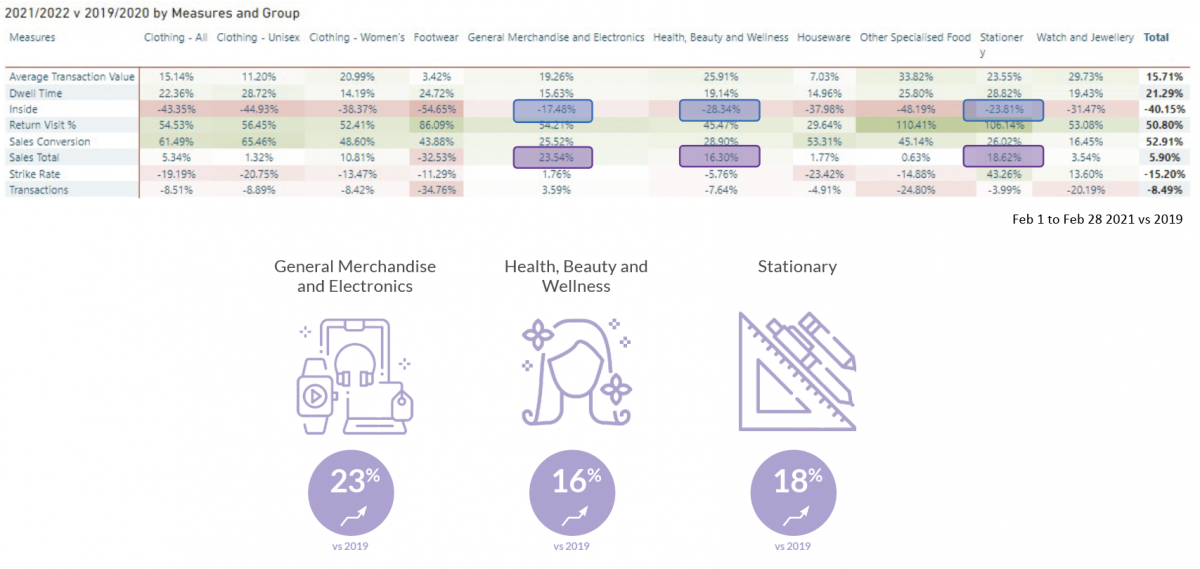

In 2021, General Merchandise and Electronics showed exceptionally strong Sales $ growth over prior years.

The key challenge to manage Inside Traffic levels is to elevate your brand’s relevance to your target market to increase repeat visits.

Click on the image to enlarge

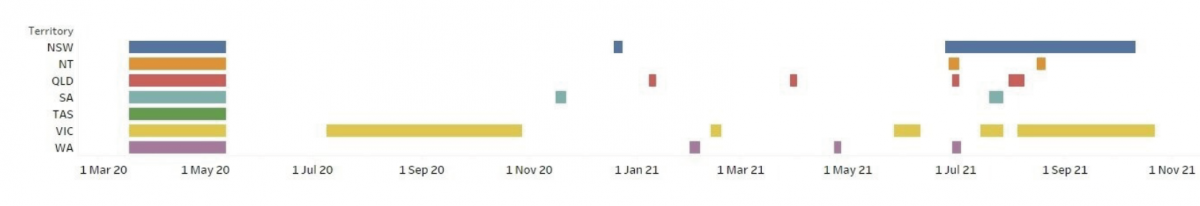

Lockdown Dates by Australian State and Territory

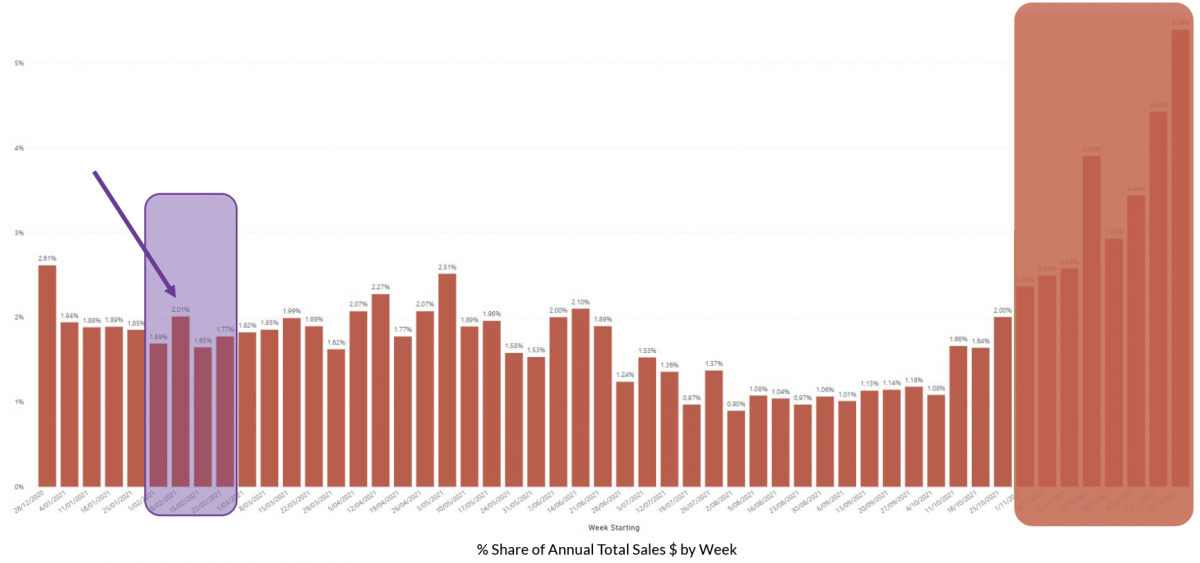

Valentine’s Day is the 7th highest Sales $ generating week pre November

As a proportion of overall Sales $ generated by retail week, in 2021 February contributed 7.1% of all Sales $ – a fairly average result. The week immediately leading into Valentine’s Day contributed almost 30% of this share and is the 7th highest Sales $ week pre-November. Valentine’s Day, though short lived, is a lucrative contributor of Sales $ for the retail year.

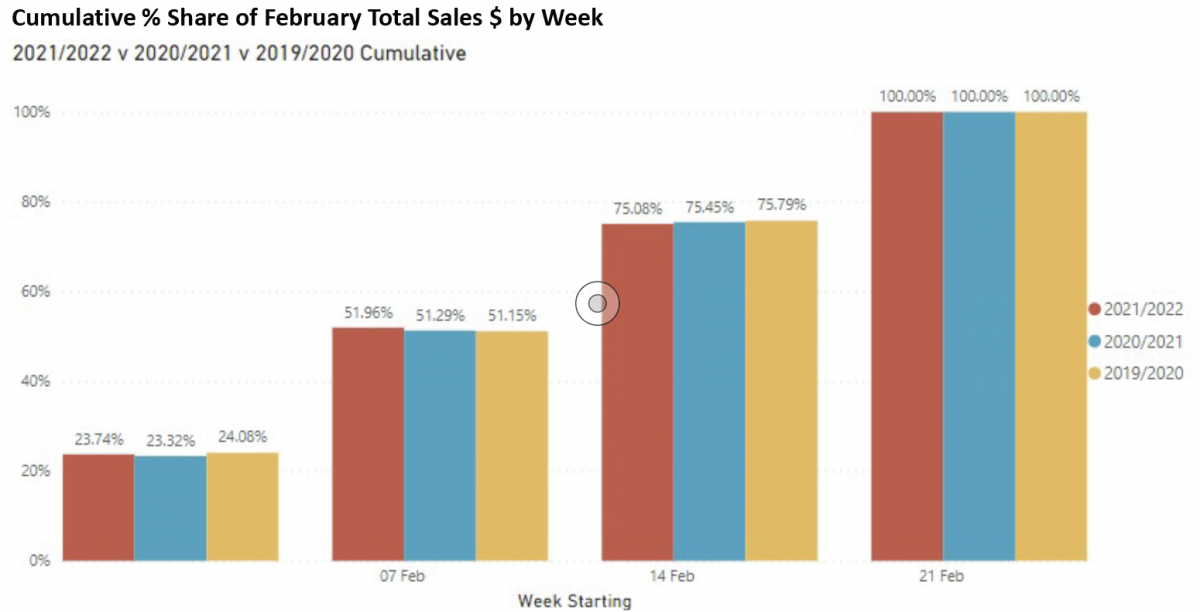

The pattern of February Sales $ has been mostly unaffected by COVID-19

Over the course of February for the last 3 years, the pattern of sales across weeks has only marginally altered with most sales occurring before February 14th, but only just before. The Valentine’s Day spike occurs in the week leading up to, and the day of Valentine’s Day itself.

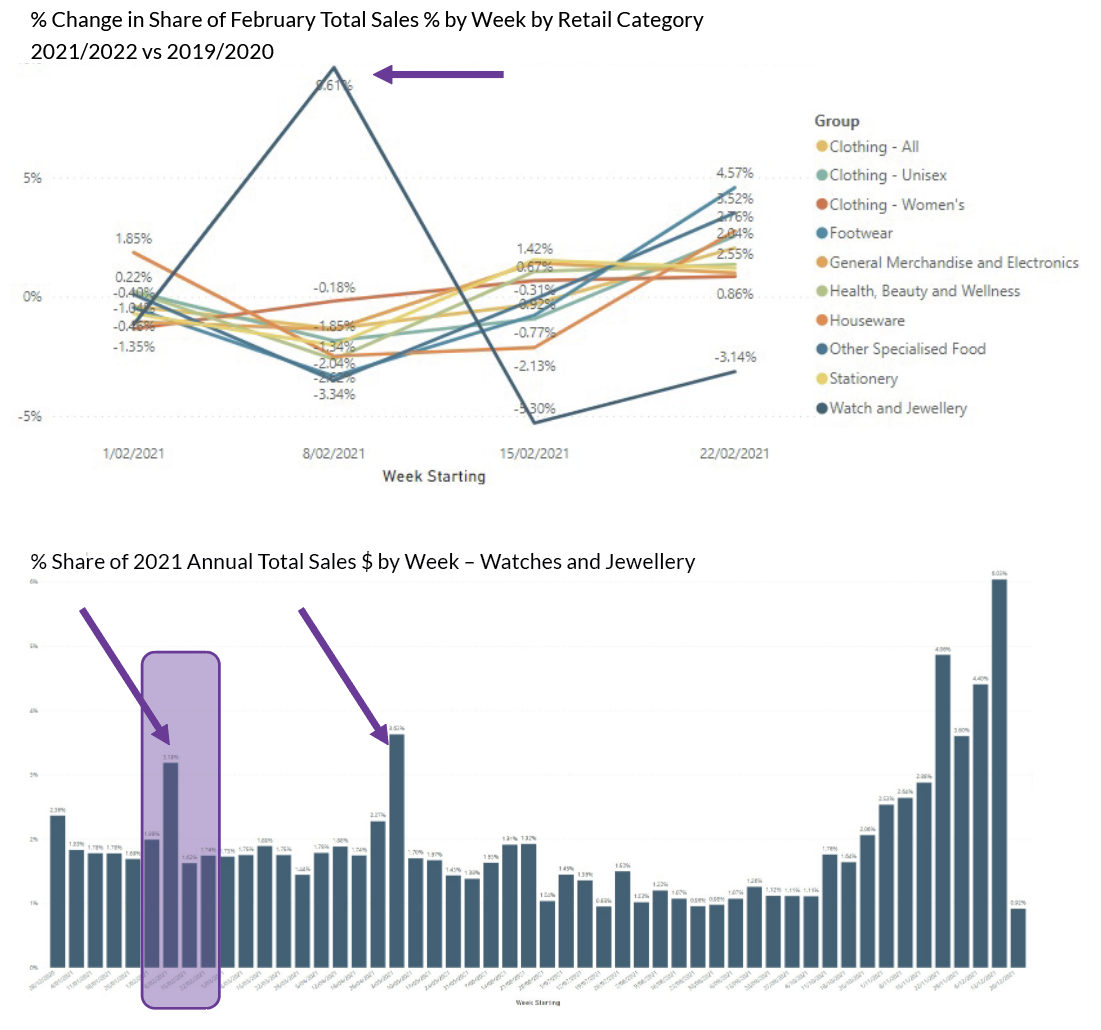

Watches and Jewellery are the gifts of choice in this week

The most affected category has been Watch and Jewellery retailers, whose share of sales has jumped by almost 10% in the week leading into Valentine’s Day – capturing a larger share of the strongest week of the year. For this category, Valentine’s week is the 6th strongest sales week of the entire year. 3.2% of all annual Watch and Jewellery transactions will occur in this week, to generate 3.1% of annual Sales $.

It is worth noting that Mothers’ Day (just a few months hence) is the 4th strongest week of the year for Sales $ for Watches and Jewellery.

Every other category in the Kepler Retail Index was not able to positively influence their sales in the key week leading into Valentine’s Day.

2021 is compared to 2019 (pre COVID-19).

Other categories are gaining more sales in February

In 2021 vs 2019, three categories had strong sales growth (see purple highlights below).

Key drivers of this Sales $ growth were Sales Conversion Rate and ATV $, with traffic substantially down. (Lockdown exceptions had an impact).

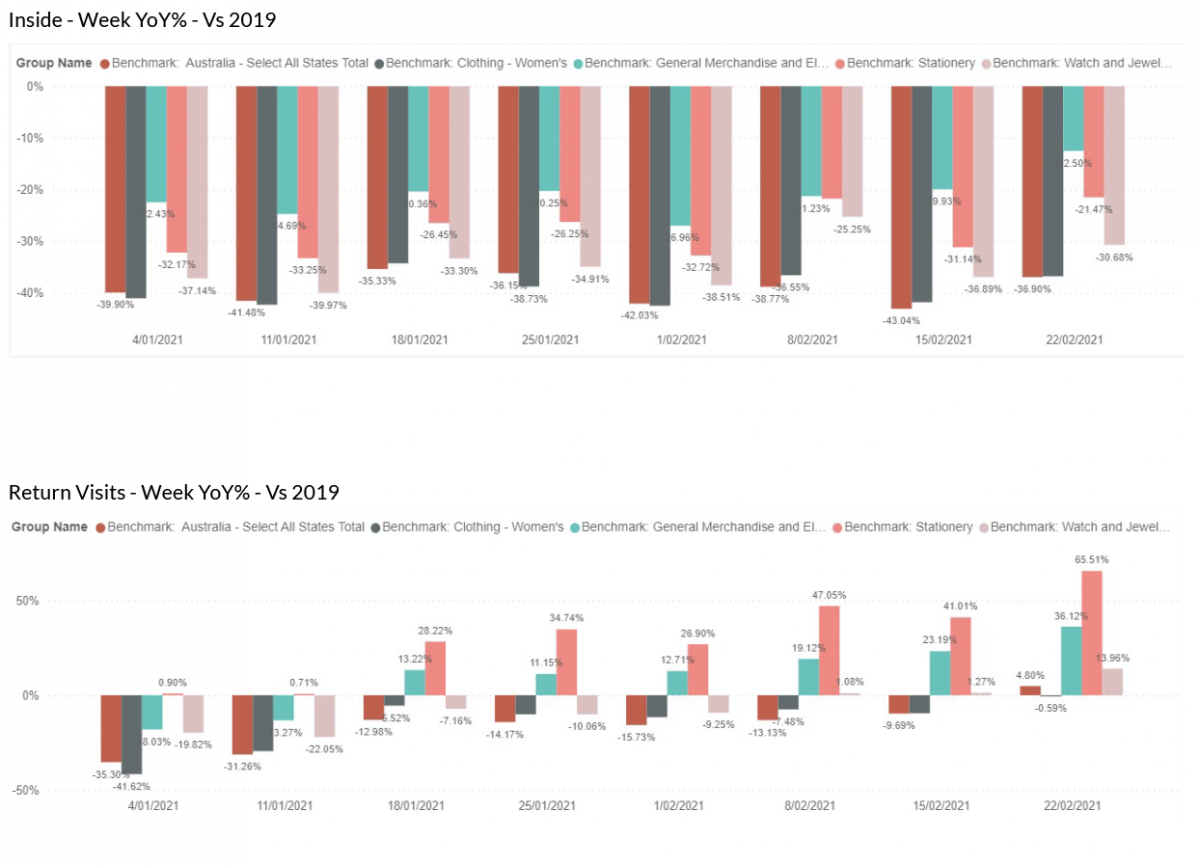

Inside Traffic is the difference between growth rates amongst winning categories

The increase in customers returning to stores mitigated lower traffic in:

- General Merchandise and Electronics; and

- Stationery

Retailers that focus on retaining Inside Traffic

Valentine’s Day is a key event in the retail calendar

The profile of trade for February has been extremely stable for 3 years.

The opportunities for retailers are to ensure that offers, stores and executions drive Inside Traffic. Inside Traffic has been under significant pressure as COVID-19 cases increased.

Customer loyalty and inspiring Return Visits into stores is central to efforts to maintaining Inside Traffic levels.

There is a suggestion in the data that February is attracting higher Sales $ in the year (Kepler will monitor trend to validate) which may affect:

- Stock availability (Chinese New Year)

- Sales expectations / store sales targets