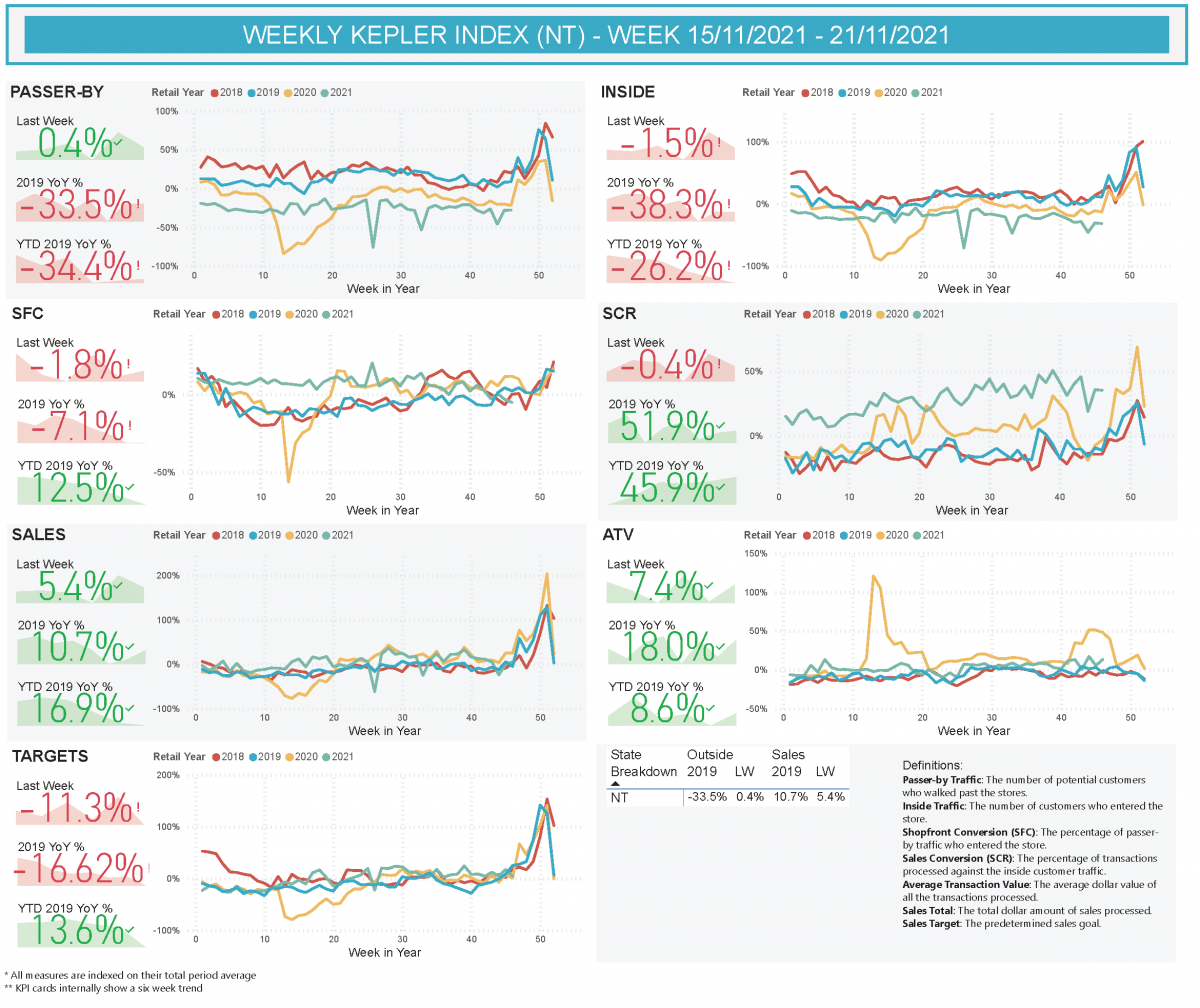

Sales

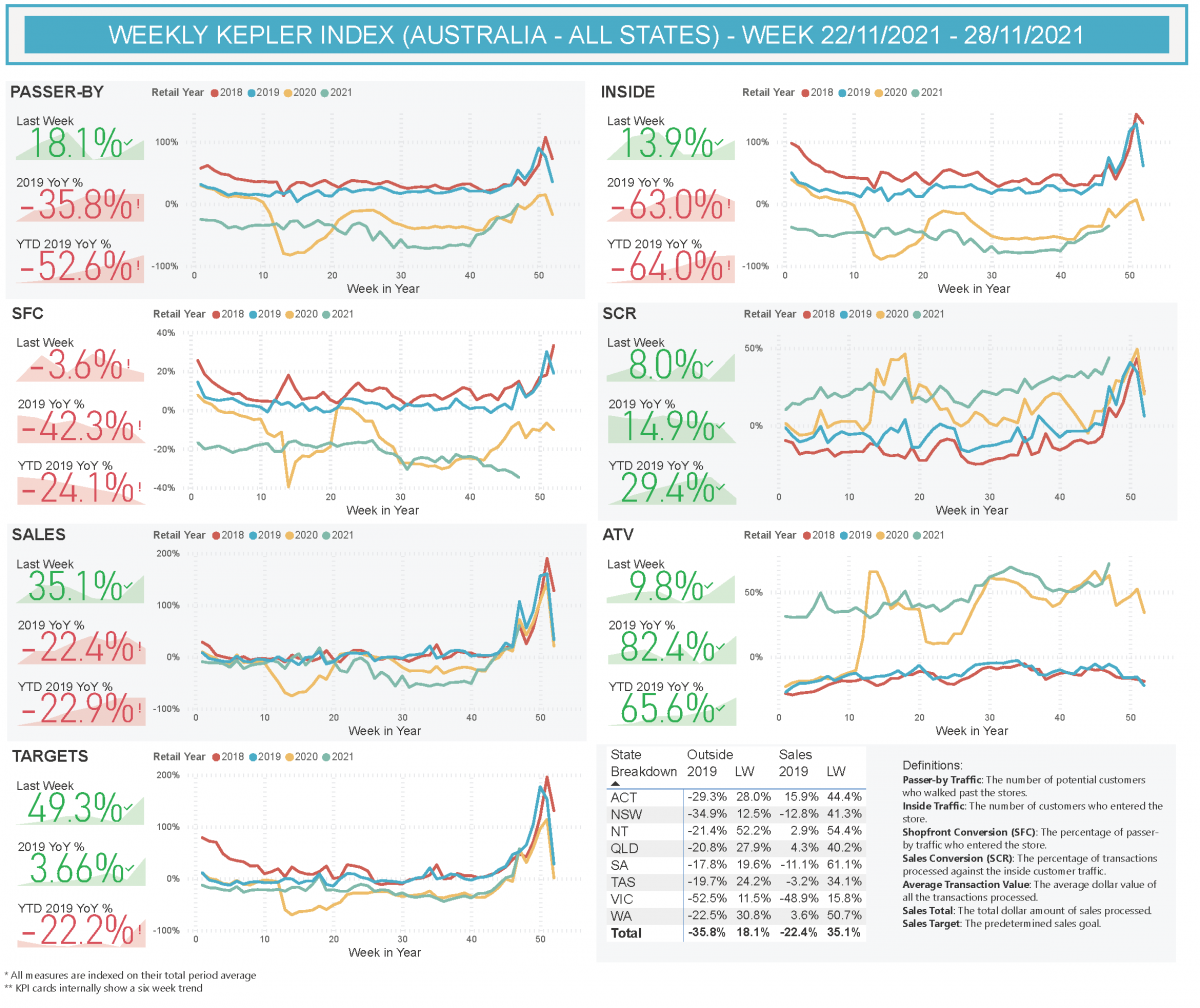

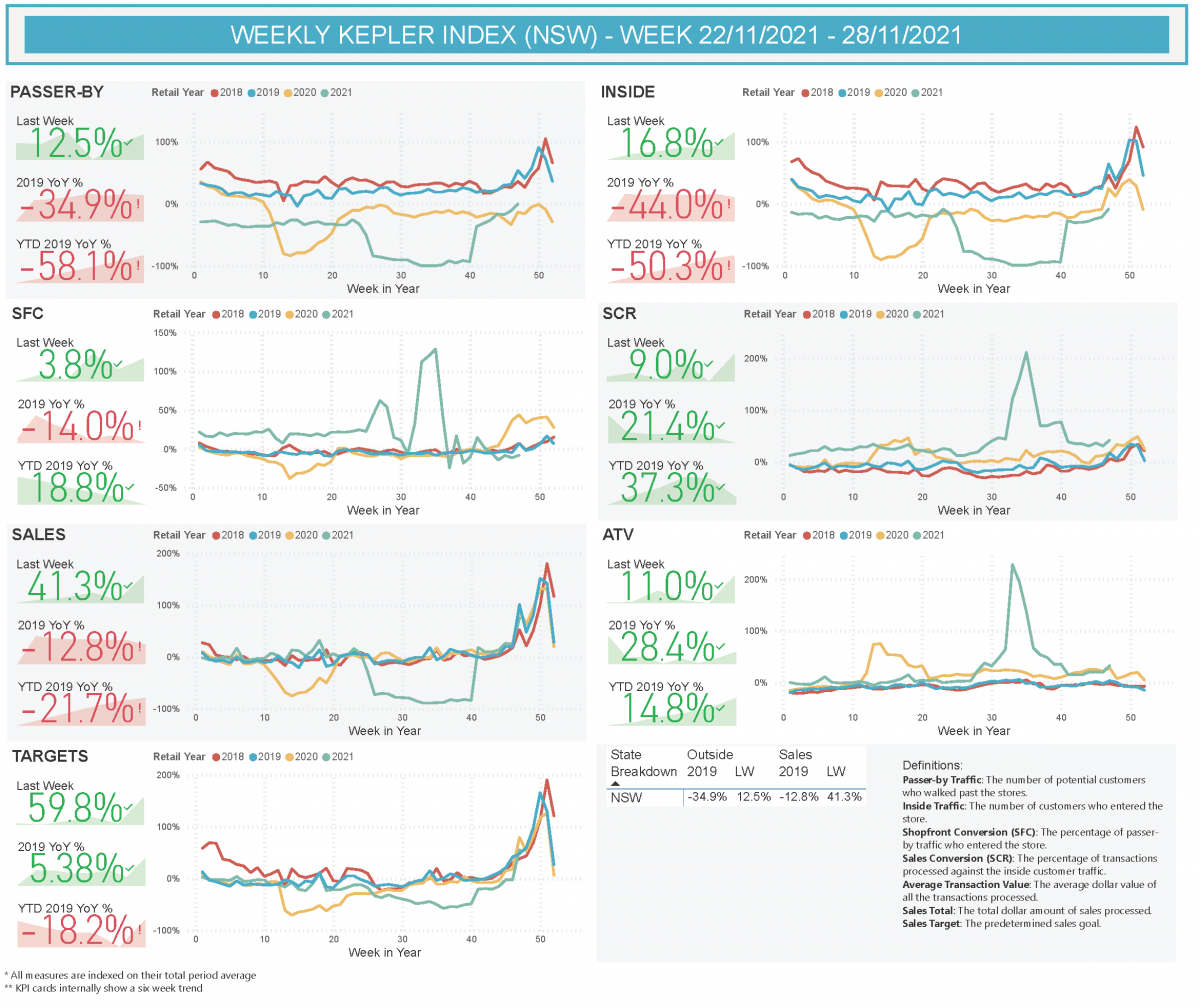

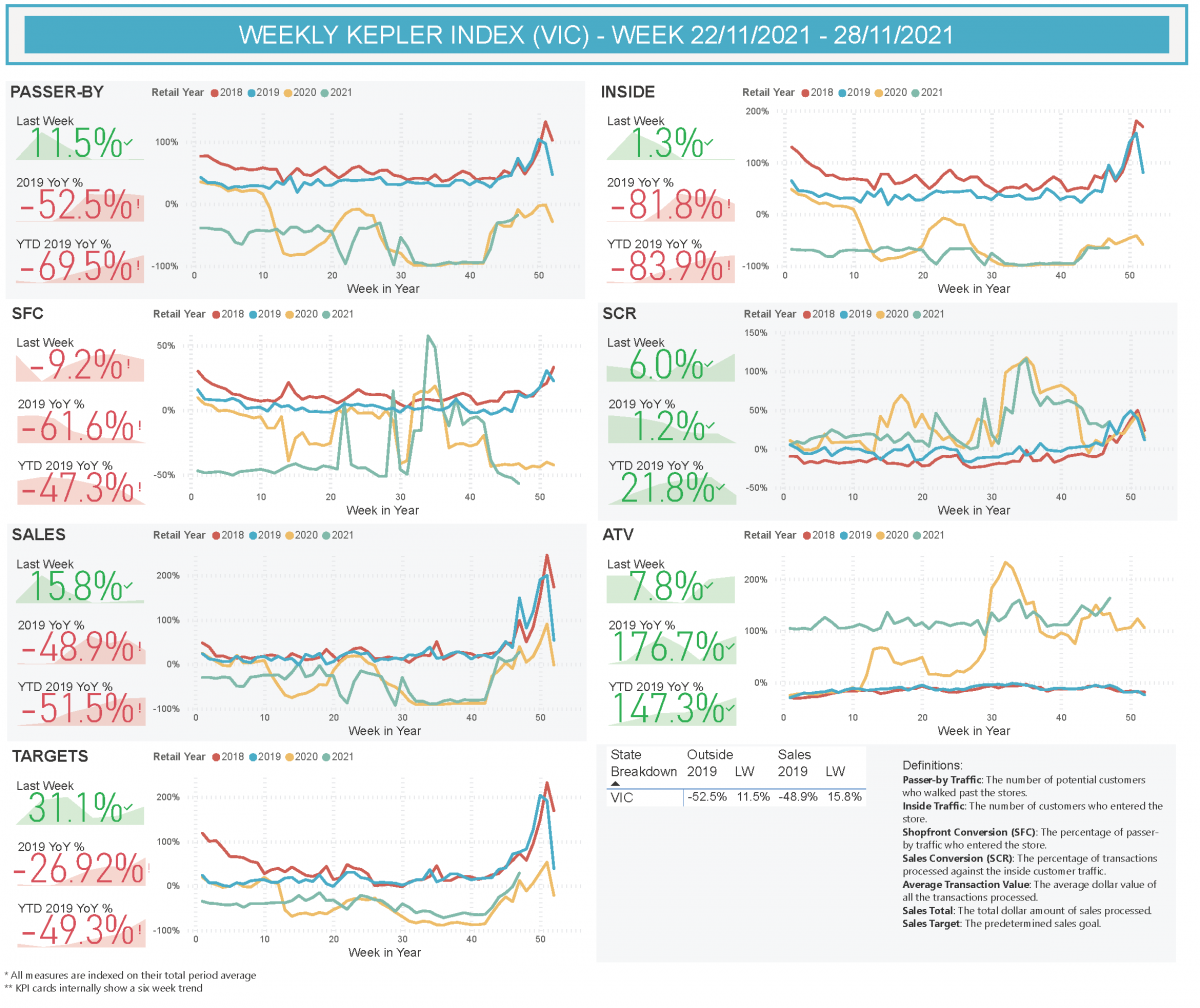

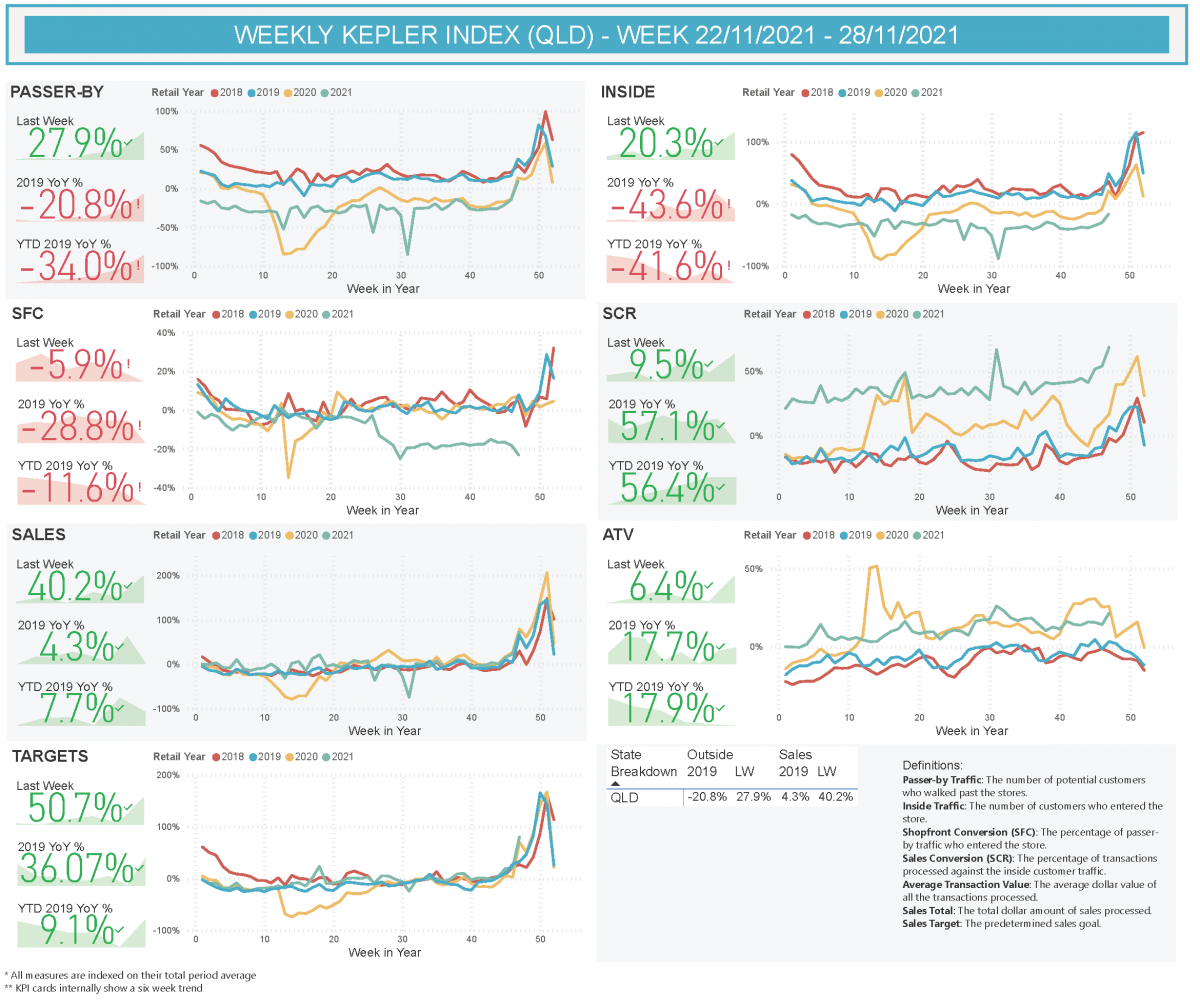

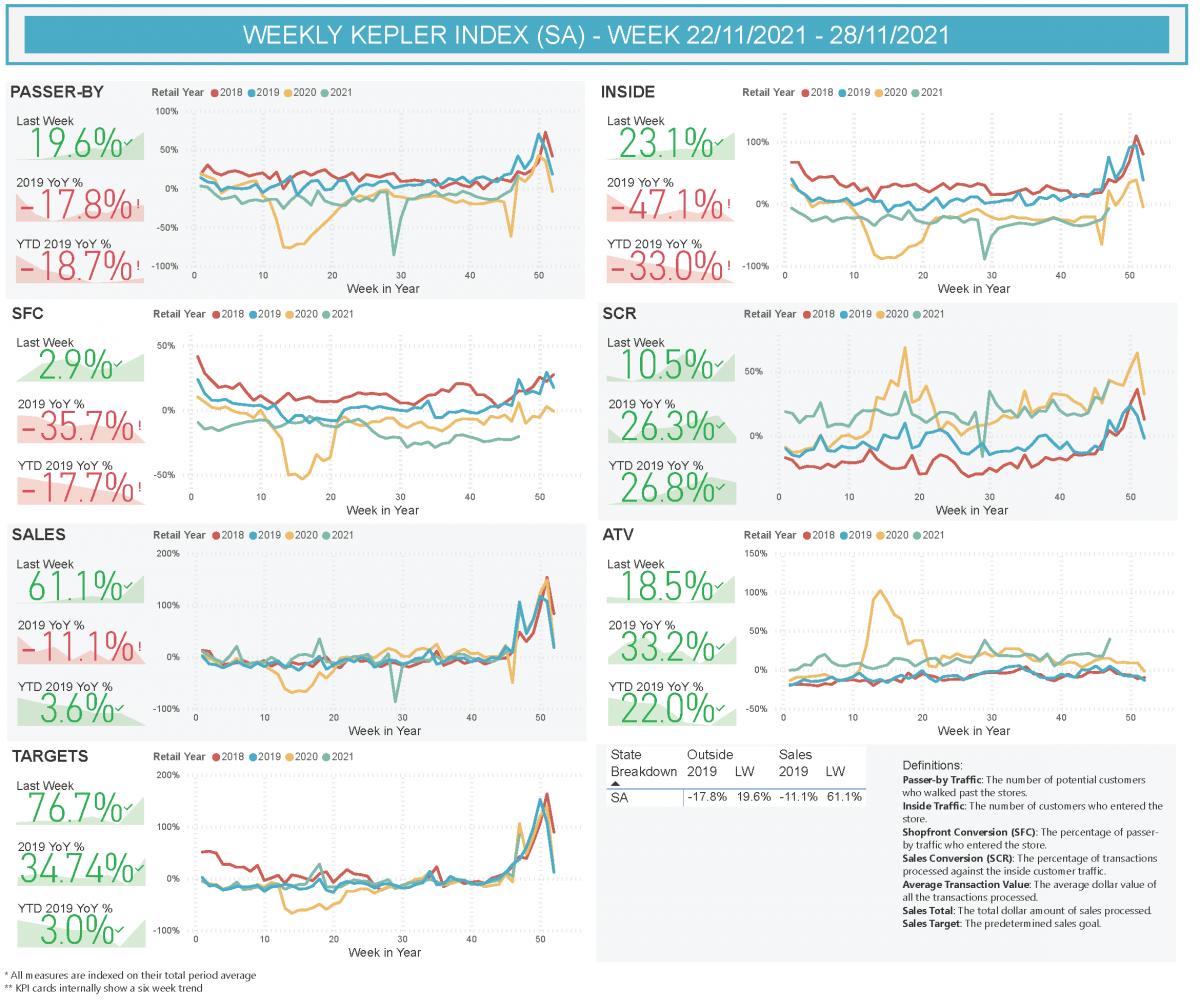

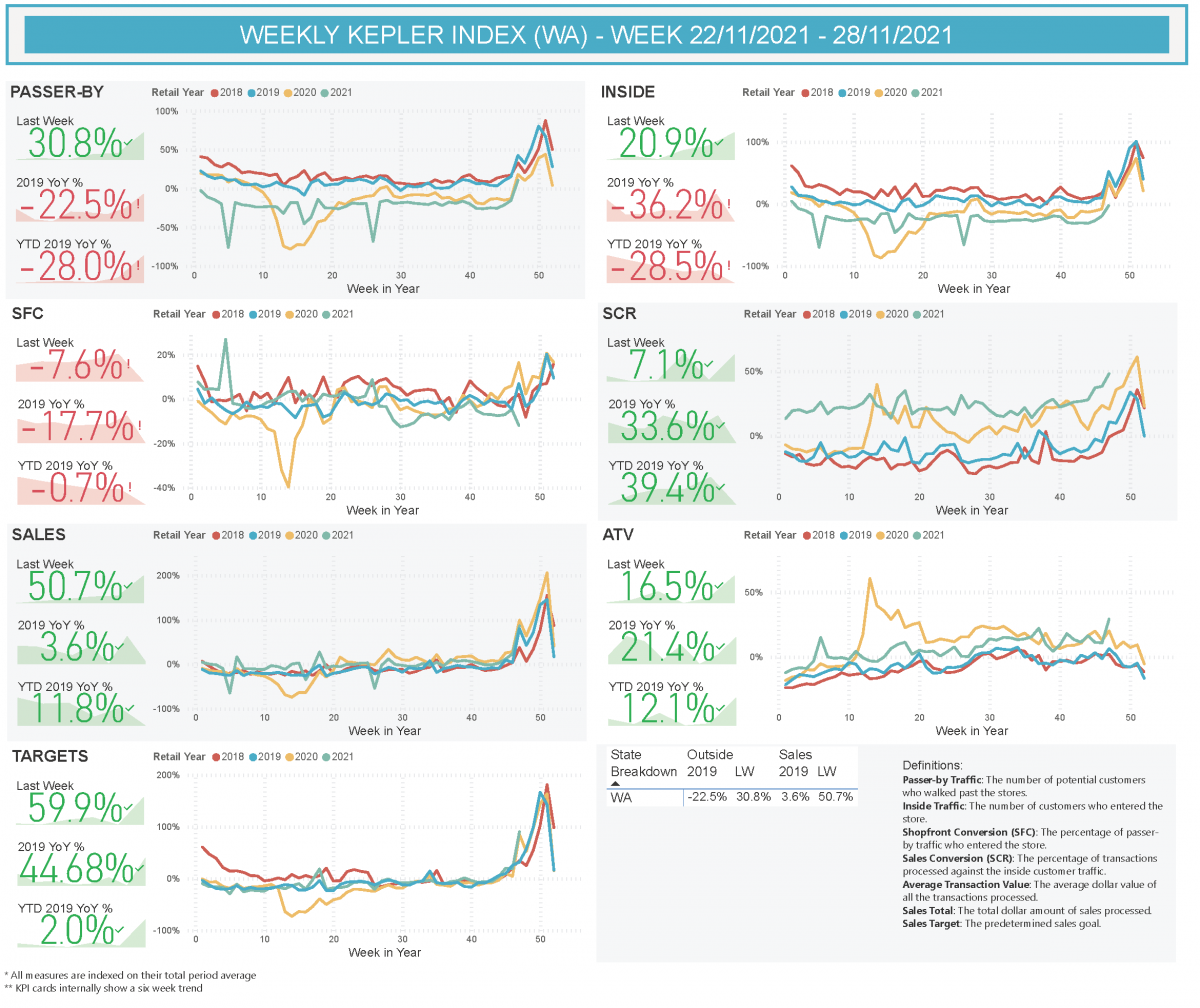

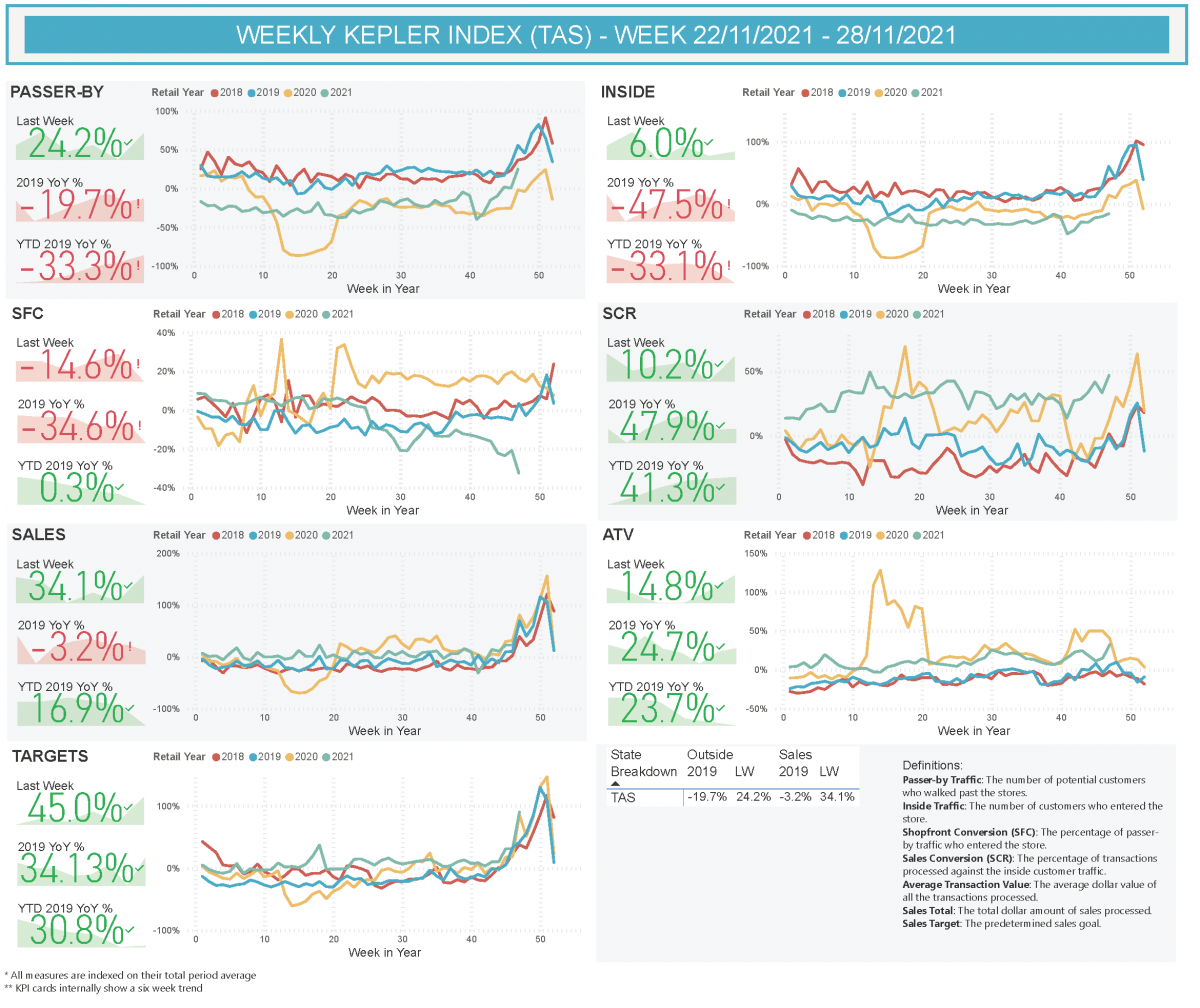

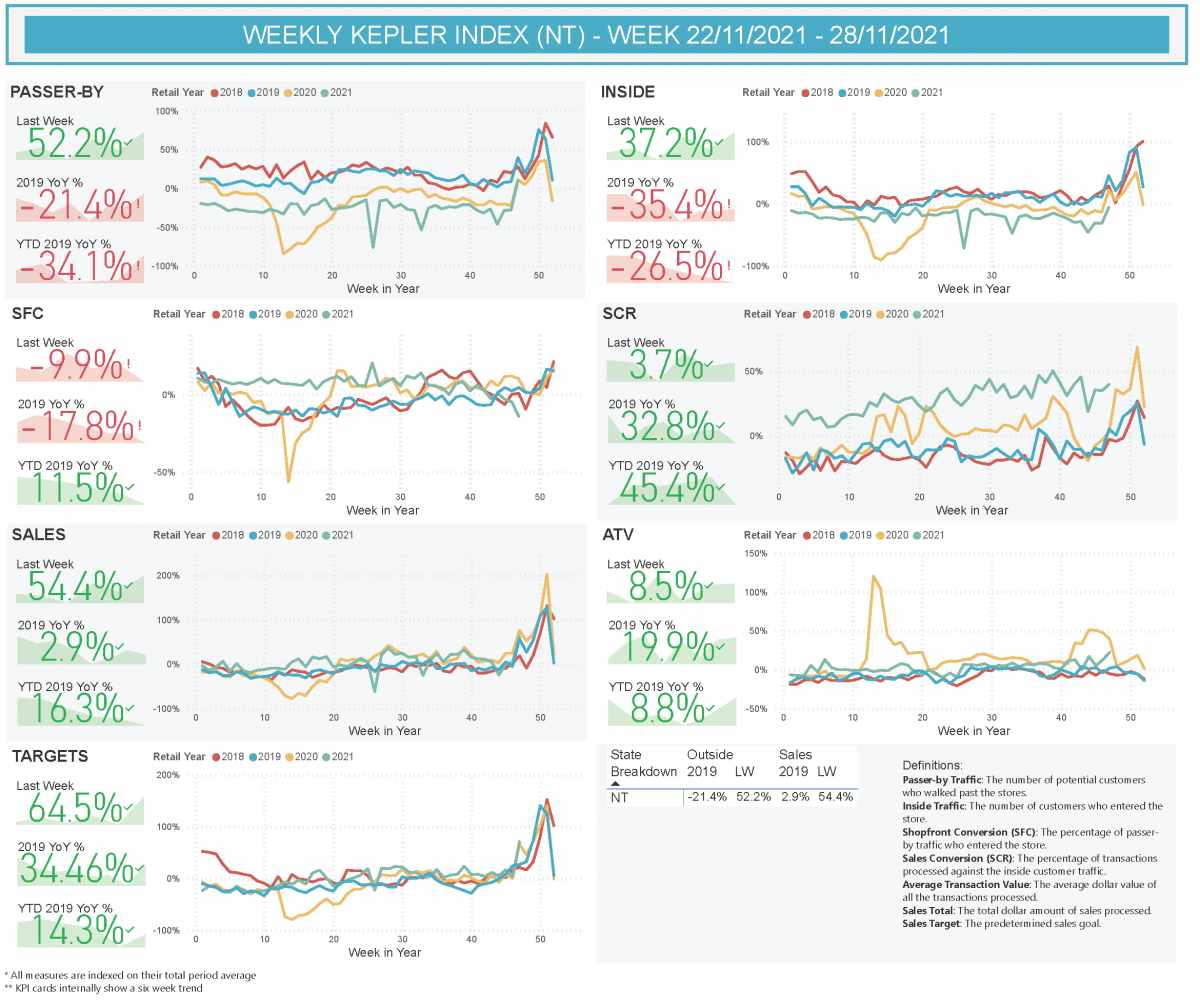

Last week showed sales still slightly below 2019 levels and YTD ~20% below 2019 levels which is understandable given the high number of days we were in lockdown.

Outside Traffic

Last week’s Outside Traffic (Passerby) picked up but are still well below the 2019 and 2018 levels. Point to note: Kepler’s Outside Traffic relates to number of visitors x number of stores they pass by – this is a true indication of the depth of traffic and does not relate to the simple number of visitors to the centres.

Sales Targets

Targets are an indication of retailers’ expectations and last week targets were ~3% higher than 2019’s actual sales levels. Expectations are that Black Friday week would exceed that of 2019 and actuals showed sales down on these expectations by up to 5%.

Sales Drivers

Both sales conversion and ATV continue at the higher levels with traffic having a high propensity to buy and buy wide! All states showed Outside Traffic (as defined above) well down on 2019!

States Comments

Black Friday week in NSW and VIC showed sales v 2019 weaker than the other states. Our view is that the strong demand after these states came out of lockdown served to moderate their Black Friday week’s sales.

Click on the image to enlarge

All States

NSW

VIC

QLD

SA

WA

TAS

ACT

NT

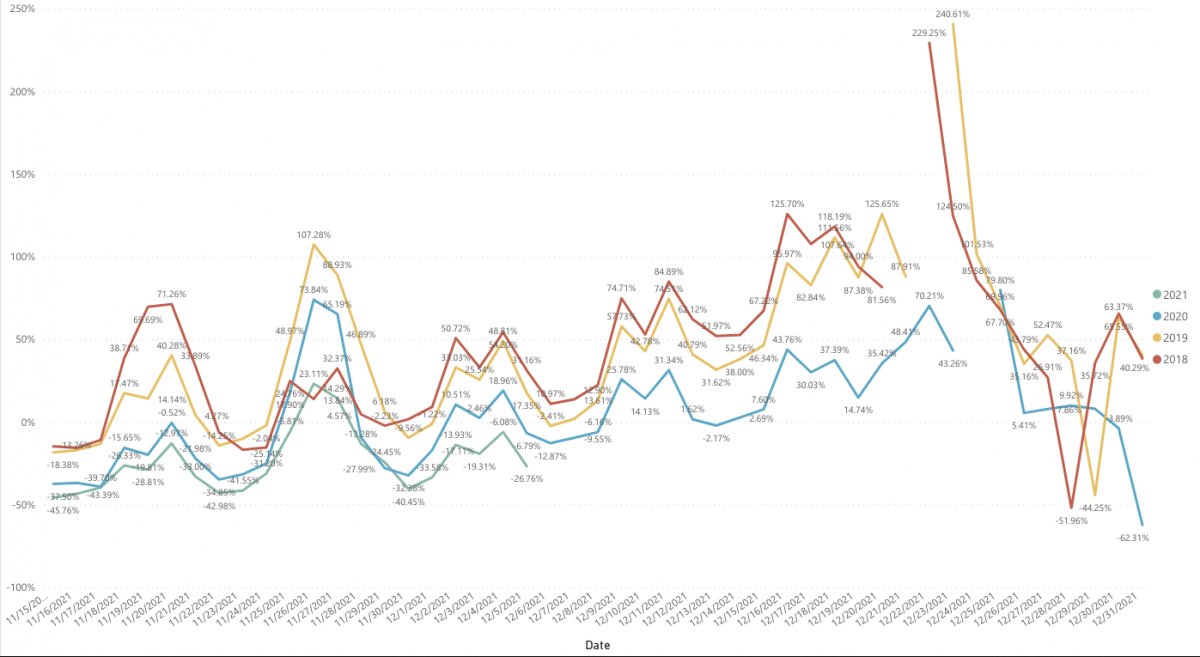

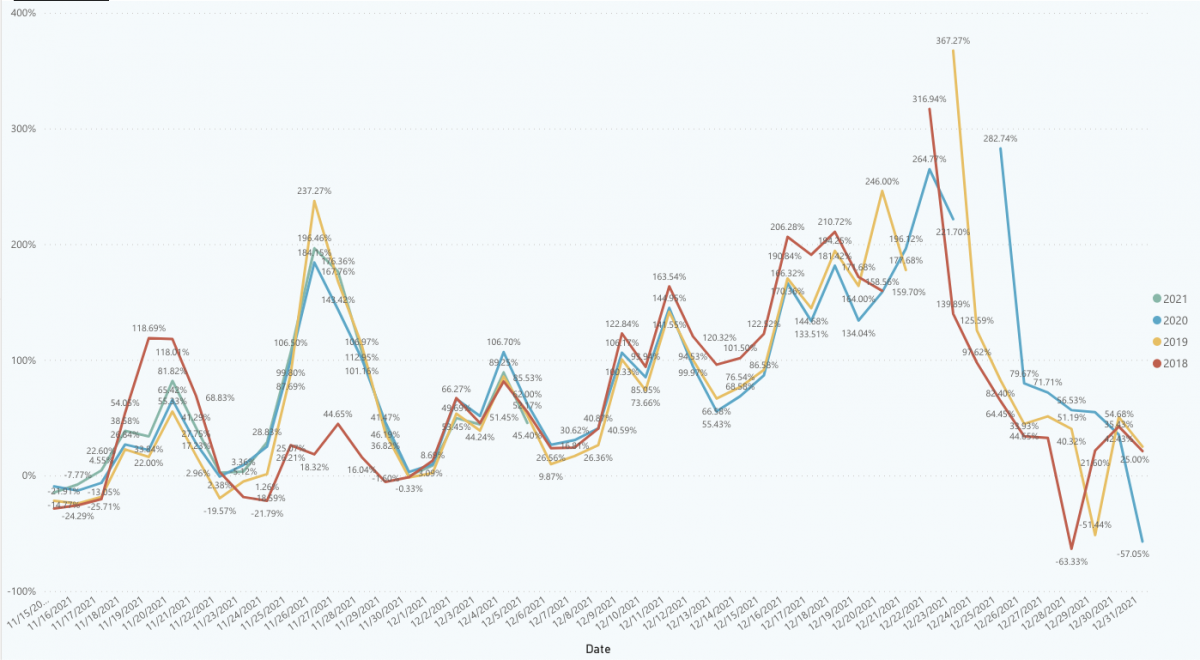

Weekly Worm

The following graphs will show the percentage (%) change vs baseline date of 1st November (2019) for each measure.

Inside Traffic

($) Sales